In this SAP FICO tutorial, the users will learn the step-by-step procedure to define new condition types for taxes using t-code OBYZ with proper screenshots.

What are Condition Types for Taxes?

The SAP system by default provides multiple condition types with pre-defined data, an SAP user can create new customized condition types by copying the existing default condition types or they can create a new condition type by using the new entries function as per their business requirements.

- The SAP transaction code OBYZ is used to define new condition types for taxes.

SAP IMG Path

SPRO > SAP Reference IMG (F5) > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Check Calculation Procedure > Define Condition types

How to Define New Condition Types for Taxes?

Please follow the steps below to define the new condition types for taxes:

Enter SAP t-code OBYZ in the SAP command field and execute it.

.jpg)

Now on Select Activity click on the Condition Type button.

.jpg)

Next on Change View “Condition: Condition Types” Overview screen you will see the list of previously defined condition types for taxes on your SAP system.

.jpg)

Next click on New Entries to define new condition types on your SAP system.

.jpg)

Now on the New Entries: Details of Added Entries details screen, enter the following fields

- Enter the condition class

- Enter the calculation type

- Enter access sequence for the tax condition type

- Choose the condition category

- Choose the group condition if it is applicable

- Update the fields “Changes which can be made”

.jpg)

After maintaining the data, click on the Save icon to save the configured data.

.jpg)

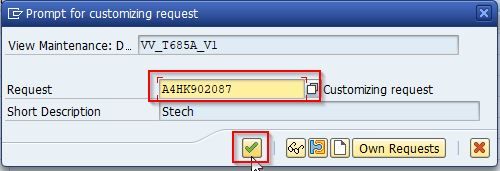

Next, select your Customization Request id and press Enter to proceed.

A message Data was saved will be displayed on the bottom of your screen.

You have successfully defined new condition types for taxes.