What is FICO Reconciliation?

FICO SAP Reconciliation refers to the process of reconciling financial data between an organization's SAP accounting records and the records generated by the FICO module of SAP.

The FICO module is used by organizations to manage financial accounting and controlling functions, such as general ledger accounting, accounts payable and receivable, asset accounting, and cost center accounting.

The reconciliation process involves comparing data between the SAP system and the FICO module to identify any discrepancies and ensure that the financial information in both systems is accurate and consistent. This process is important for financial reporting, compliance, and decision-making purposes.

Types of Reconciliations in SAP FICO

Here are some of the types of reconciliations that can be performed in SAP FICO:

- Vendor Reconciliation: Vendor reconciliation involves reconciling accounts payable transactions with vendor statements to ensure the accuracy and completeness of vendor balances. This process involves identifying and resolving discrepancies between the accounts payable balance in the company's books and the vendor's balance in their records.

- Customer Reconciliation: Customer reconciliation involves reconciling accounts receivable transactions with customer statements to ensure the accuracy and completeness of customer balances. This process involves identifying and resolving discrepancies between the accounts receivable balance in the company's books and the customer's balance in their records.

- Bank Reconciliation: Bank reconciliation involves reconciling bank account transactions with bank statements to ensure the accuracy and completeness of bank balances. This process involves identifying and resolving discrepancies between the bank account balance in the company's books and the bank's balance in their records.

- Intercompany Reconciliation: Intercompany reconciliation involves reconciling transactions between different companies within the same group to ensure accurate financial reporting. This process involves identifying and resolving discrepancies between intercompany transactions in the books of each company.

- Balance Sheet Reconciliation: Balance sheet reconciliation involves reconciling all balance sheet accounts in the company's books to ensure the accuracy of financial statements. This process involves verifying that the balances in each balance sheet account match the actual amounts and resolving any discrepancies.

- General Ledger Reconciliation: General ledger reconciliation involves reconciling all transactions recorded in the general ledger to ensure the accuracy and completeness of financial statements. This process involves verifying that all transactions have been recorded correctly and resolving any discrepancies.

Functions of FICO Reconciliation

The functions of SAP FICO Reconciliation include:

- Comparing and reconciling financial data: The primary function of SAP FICO Reconciliation is to compare and reconcile financial data between an organization's SAP accounting records and the records generated by the FICO module. This helps to identify any discrepancies and ensure the accuracy of financial information.

- Identifying errors and omissions: The reconciliation process helps to identify errors and omissions in financial data, such as missing transactions, duplicate entries, and incorrect posting of transactions.

- Ensuring compliance: SAP FICO Reconciliation helps organizations ensure compliance with accounting standards and regulations, such as GAAP and IFRS.

- Improving financial reporting: Accurate and consistent financial data helps organizations to produce reliable financial reports that can be used for decision-making purposes.

- Supporting decision-making: By providing accurate financial data, SAP FICO Reconciliation supports decision-making processes related to budgeting, forecasting, and financial planning.

- Improving efficiency: The reconciliation process helps to improve the efficiency of financial operations by reducing the time and effort required to identify and correct errors in financial data.

Limitations of SAP FICO Reconciliation

Some limitations of SAP FICO Reconciliation include:

- Manual reconciliation required: While the reconciliation process can be automated to some extent, there may still be a need for manual intervention to identify and resolve discrepancies, especially in complex transactions.

- Time-consuming: The reconciliation process can be time-consuming, particularly for organizations with large volumes of financial data, which can impact the speed of financial reporting and decision-making.

- Risk of human error: The reconciliation process involves multiple steps, and there is a risk of human error in the identification and resolution of discrepancies.

- Lack of integration with other systems: The FICO module of SAP may not be integrated with other systems used by the organization, which can lead to challenges in reconciling data across different systems.

- Limited scope: The FICO module of SAP primarily focuses on financial accounting and controlling functions, and may not provide a comprehensive view of an organization's financial data.

- High cost: Implementing and maintaining SAP FICO Reconciliation can be expensive, particularly for small and mid-size.

How to Configure FICO Reconciliation?

Please follow the steps below to perform the basic configuration of FICO reconciliation:

1. Activate Reconciliation Accounts

b If the CO area created by the user is new then the reconciliation account active will be activated by default.

2. Assignment of Recon document type to the Controlling area.

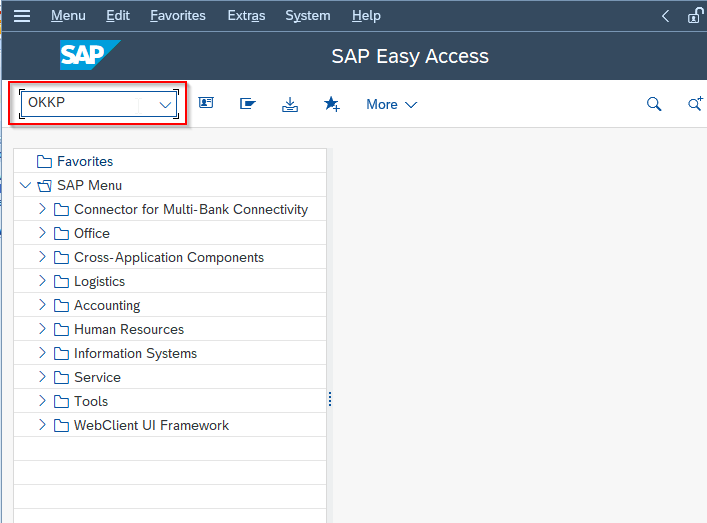

Execute t-code OKKP in the SAP command field.

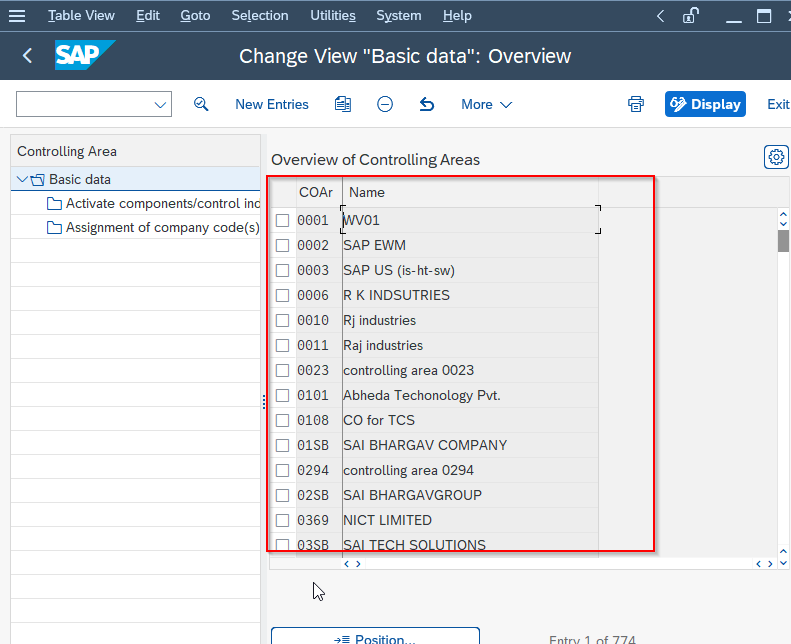

Next on Change View "Basic data": Overview screen you will see the list of Controlling area

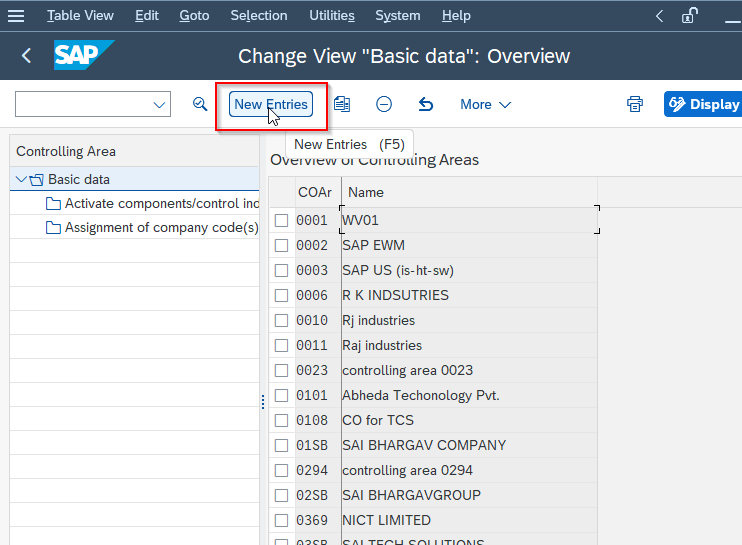

Click on the New Enteries button as shown in the image below.

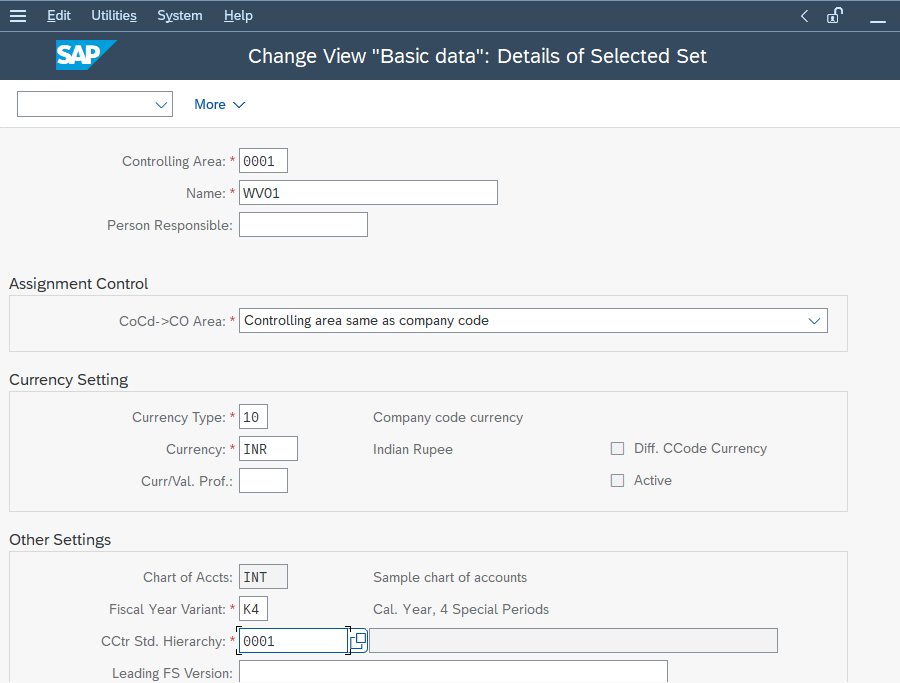

Enter all the details according to your requirements.

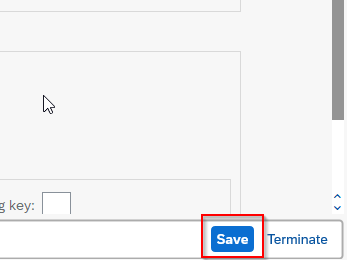

Once all the fields are entered click on the Save button to save the entry.

3. Creating Clearing Accts

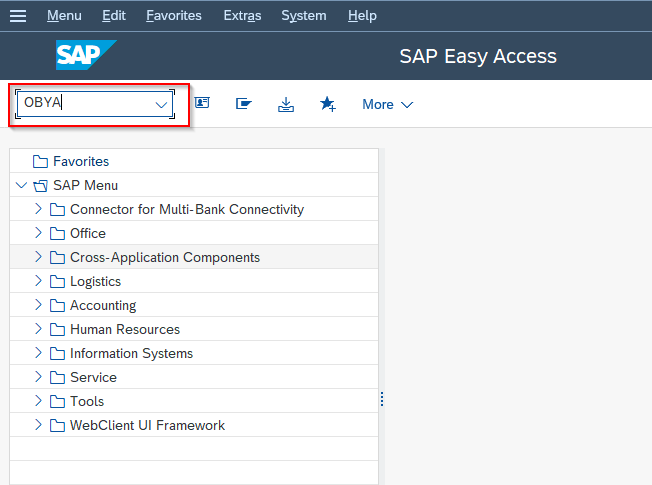

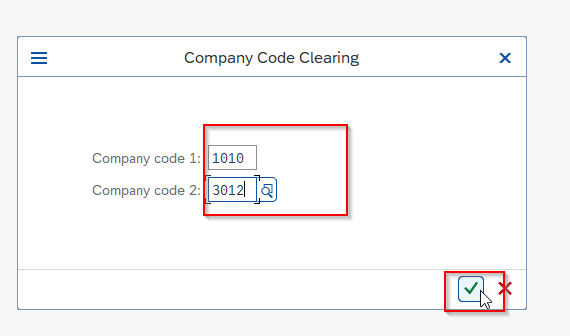

Enter t-code OBYA in the SAP commndi field and Execute it.

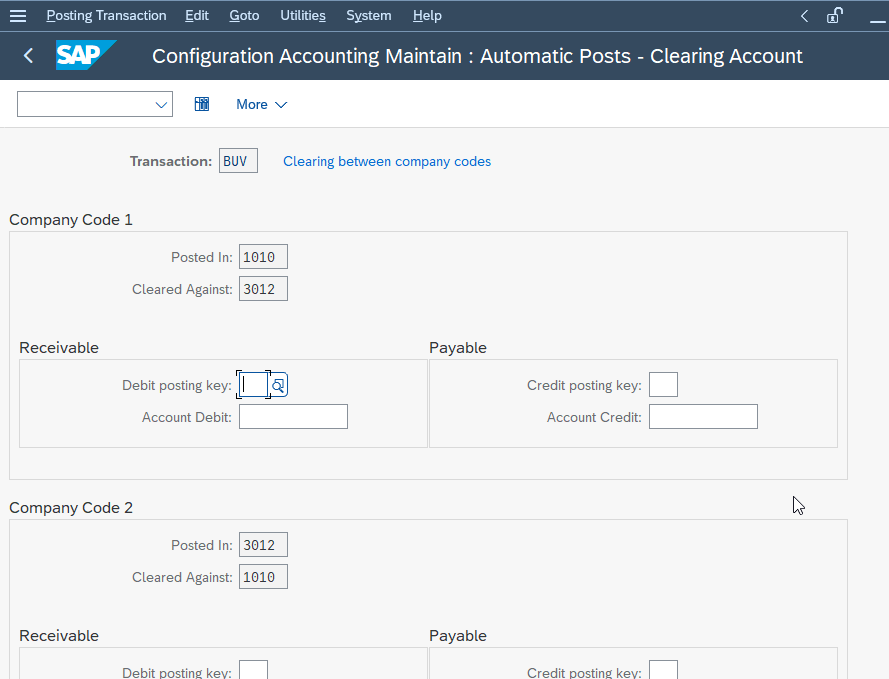

Enter the Company codes and press Enter to proceed

Now on the next screen enter all the details according to business requirements

Next click on the Save button at the bottom to save the confoguration

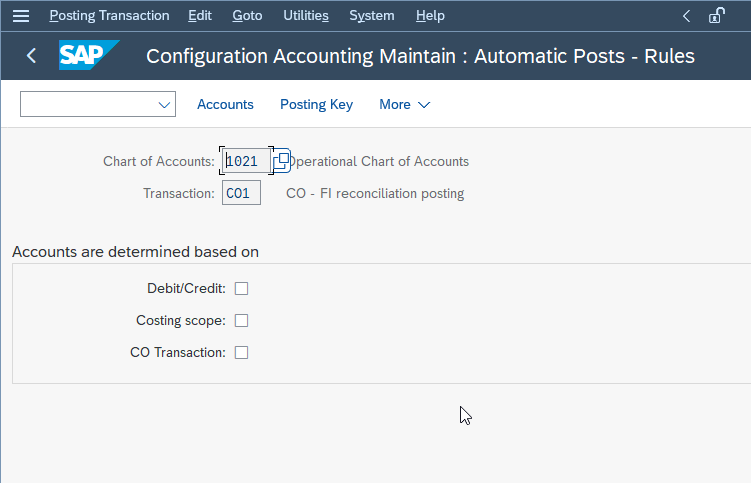

4. Maintain accts for Automatic Recon posting

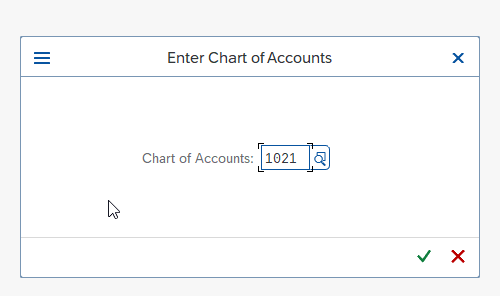

Execute t-code OBYB in the SAP command field

.png)

Enter the Chart of Accounts and press Enter key to proceed

Next enter all the fields according to your reuirements.

Click on the Save button to save the configuration.

5. Assign Number ranges to Recon activity

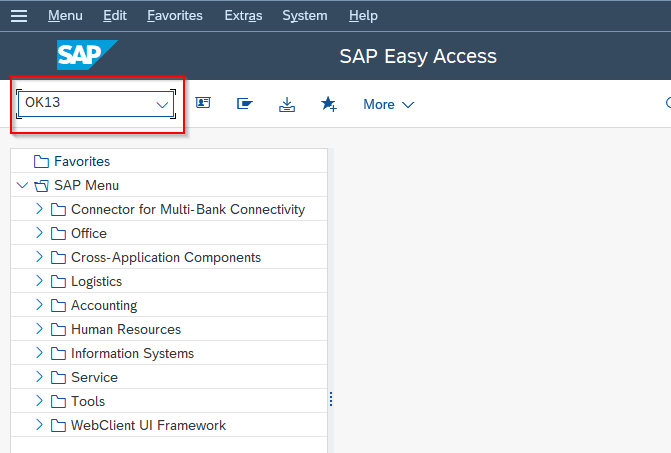

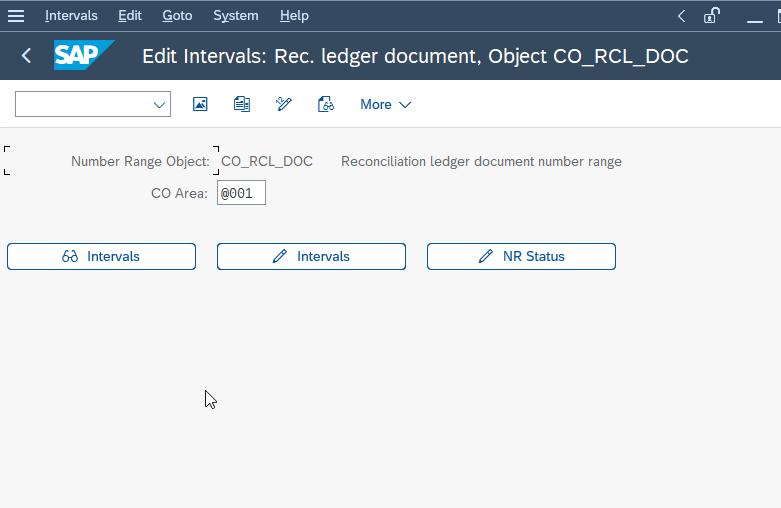

Enter t-code OK13 in the SAP command field and execute it

On the next screen, assign number ranges to the Reconciliation activity.

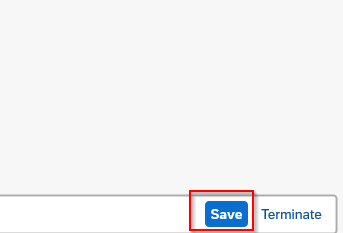

Click on the Save button at the bottom to save the configuration

Note: Specific steps and configuration for FICO reconciliation may vary depending on your organization's requirements and processes.