This tutorial explains the configuration process of setting up STO (Stock Transfer Order) process for GST India.

Configure Plant as a Vendor

The plant that has to be sent in the Stock Transfer process should always be configured as a Vendor

Please follow the steps below in order to configure plant as vendor:

- First, execute the t-code for Vendor Creation/Change and provide the Vendor, Purchasing Org details and Company code.

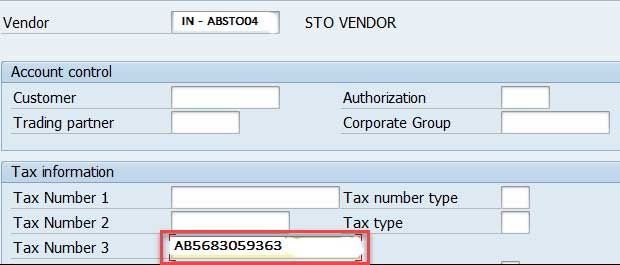

- Now inside the CONTROL view of the vendor please maintain the relevant GSTIN for the plant within the Tax Number 3 field.

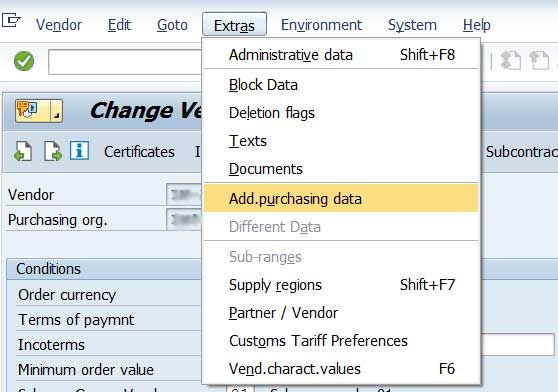

- Now inside the PURCHASING DATA view of the vendor go to Extras -> Add. Purchasing data

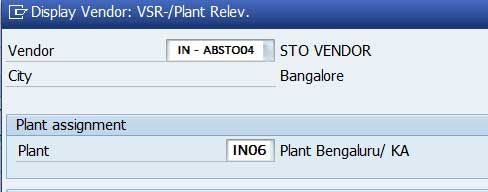

- Now lastly please assign the suitable plant to the vendor

Configure Plant as a Customer

Now the plant which will receive the stock in this Stock Transfer process should be configured as Customer

Please follow the steps below in order to configure receiving plant as a customer:

- First, execute the t-code for the Customer Creation/Change and provide the Customer, Sales area details and Company code.

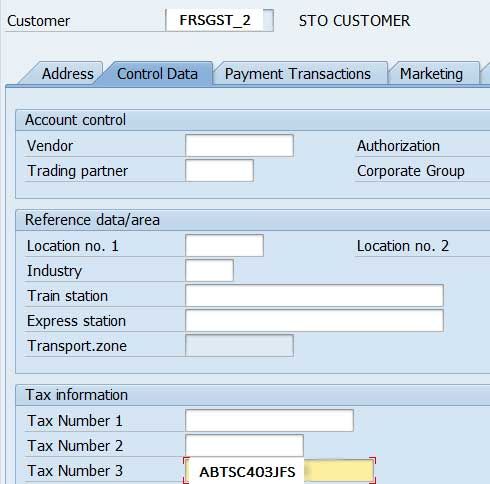

- Now within the CONTROL DATA view of the vendor please maintain the appropriate GSTIN for the plant inside the field Tax Number 3.

- Now from SPRO, please go to the following path

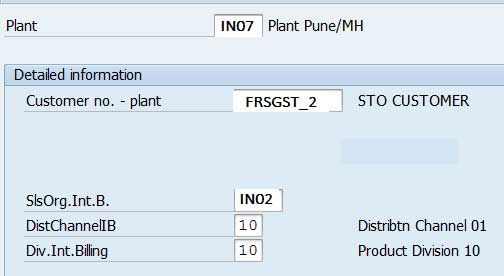

Materials Management - > Purchasing -> Purchase Order -> Set Up Stock transfer -> Define Shipping data for Plants - Now after assigning the customer number please save the data.

Create Info Record

Please follow the steps below in order to create information record:

- First execute the t-code for Info record creation/change and provide the information about the Vendor, Material, Purchasing Org and Plant.

- Now please check the Info Catagory as 'STANDARD'.

- Now please maintain the FI relevant Tax code inside the Purchasing Org data view and save the data.

.jpg)

New Billing Document Type

A new document type must be created for outbound GST invoice.

Please follow the steps below in order to create a new document type:

- First execute the t-code VOFA

- Then please copy the F2 into CGST

- Now billing type details like 'Document Type', 'Cancell.Billing Type', etc can be configured as per your business needs.

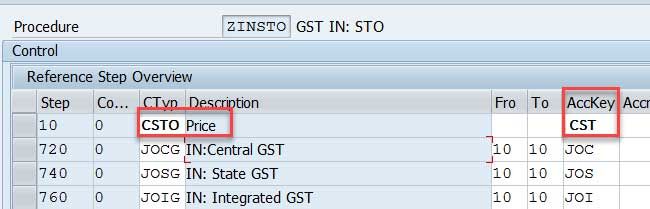

Pricing Procedure for STO Billing

It is always recommended to configure a separate pricing procedure for the new billing type created above

The image below is only an example

The user can configure the pricing procedure according to their business needs. The condition type for base price (CSTO in the above image) must be configured accordingly as it may be used as a base for GST tax calculations. Please make sure that the relevant Accounting Key against the base condition type. Also please maintain suitable G/L accounts for this accounting key and not the sales revenue related accounts. These G/L accounts are determined with the help of accounting key which is used as intermediate accounts for GST invoice postings.

Copy Control

Now lastly please set up ‘Delivery to Billing’ copy control.'

Please follow the steps below in order to set Delivery to Billing copy control:

- First execute t-code VTFL.

- Now create a copy control for the new Billing type CGST created above by copying the existing copy control setting of the Billing type ‘F2’ and delivery ‘LF’.

Note: If the user is using any other document type other than LF for Outbound deliveries w.r.t STO process, then the copy control must be set according to that.

Note: This document is not to be considered final, and all information contained herein is subject to change. Therefore, this document is not to be quoted, in any reference, or used by anyone for any purpose other than as a draft document.