What is SAP FICO?SAP FICO Training Tutorials for BeginnersSAP FICO Define Account GroupSAP FICO Reverse Clearing DocumentForeign Currency Valuation ConfigurationSAP FICO User Exit for Vendor MasterFICO Vendor Account Group TableSAP FICO Withholding TaxSAP FICO Dunning AreaSAP FICO Cash Management GroupAssessment Cycle vs Profit CenterSAP FICO Asset AccountingSAP FICO Posting Key for BankSAP FICO Document TypeSAP FICO Document Number RangesSAP FICO Parked Workflow ConfigurationSAP FICO Classic GL vs New GLSAP FICO GL Account for Cash JournalSAP FICO Accounts Receivable Process CycleSAP FICO Accounts Receivable ConfigurationGR/IR Accounting Entries and Journal EntriesSAP FICO Chart of AccountsSAP FICO Transaction CodesSAP AS11 Create Asset Sub-NumberSAP Business Area and Profit CenterSAP Inconsistent Withholding Tax InfoSAP Active vs Passive Document SplittingReverse MIRO Document in SAPSAP FICO Scope and OpportunityFICO Certification Cost in IndiaSAP FICO Interview QuestionsSAP FICO Tree Menu

Tutorials

- What is SAP FICO?

- SAP FICO Training Tutorials for Beginners

- SAP FICO Define Account Group

- SAP FICO Reverse Clearing Document

- Foreign Currency Valuation Configuration

- SAP FICO User Exit for Vendor Master

- FICO Vendor Account Group Table

- SAP FICO Withholding Tax

- SAP FICO Dunning Area

- SAP FICO Cash Management Group

- Assessment Cycle vs Profit Center

- SAP FICO Asset Accounting

- SAP FICO Posting Key for Bank

- SAP FICO Document Type

- SAP FICO Document Number Ranges

- SAP FICO Parked Workflow Configuration

- SAP FICO Classic GL vs New GL

- SAP FICO GL Account for Cash Journal

- SAP FICO Accounts Receivable Process Cycle

- SAP FICO Accounts Receivable Configuration

- GR/IR Accounting Entries and Journal Entries

- SAP FICO Chart of Accounts

- SAP FICO Transaction Codes

- SAP AS11 Create Asset Sub-Number

- SAP Business Area and Profit Center

- SAP Inconsistent Withholding Tax Info

- SAP Active vs Passive Document Splitting

- Reverse MIRO Document in SAP

- SAP FICO Scope and Opportunity

- FICO Certification Cost in India

- SAP FICO Interview Questions

- SAP FICO Tree Menu

FICO (Financial Accounting and Controlling) Tutorial

Accounting Entries

Accounting Entries

1.1 All the Inventory transactions will look for the valuation class and the corresponding G.L. Accounts and post the values in the G.L accounts.For E ... General setting for SAP system, Date Time, Currency and Number format

Answered

General setting for SAP system, Date Time, Currency and Number format

Answered

General setting for your SAP system, Date Time, Currency and Number format You can do the general setting for currency, date time, number format ... SAP FICO Career, Scope and become Certified Consultant

SAP FICO Career, Scope and become Certified Consultant

Scope and Opportunity of a Career in SAP FICO In depth knowledge of essential ERP Systems is a must for those wanting to get their hands on the imp ... SAP FICO Training Material with Screen Shots

SAP FICO Training Material with Screen Shots

This tutorial contains the Complete list of SAP FICO Training Material with Screen Shorts Create a Company Code (OX02) T-code (OX02) Path Enter ... SAP FI (Financial Accounting) Module

SAP FI (Financial Accounting) Module

SAP FI (Financial Accounting) IntroductionThe SAP FI CO (Financial Accounting & Controlling) Module has the capability of meeting all the accounti ... SAP FICO Certification Fee and Course Duration in India

SAP FICO Certification Fee and Course Duration in India

The SAP FI/CO course begins with a business analysis by defining business environment, procedures and planning methodologies. Then financial ... ASSET ACCOUNTING Configuration Steps

ASSET ACCOUNTING Configuration Steps

How to Configure ASSET ACCOUNTING in SAP FICO?Step 1 – COPY CHART DEPRECIATIONEC08 – IMG>Financial Accounting > Asset Accounting > ... Withholding Tax in SAP

Withholding Tax in SAP

Detail information about Withholding Tax1. Types of withholding Tax a. Standard Withholding Tax provides the following features:i. Withholding ta ... Create New Tax code in SAP

Create New Tax code in SAP

T.code FTXP is used to create Tax code.All the Taxes are divided into two categories. Input tax: All taxes related to purchase are considered as Input ... Indian Tax Procedure Migration from TAXINJ to TAXINN.

Indian Tax Procedure Migration from TAXINJ to TAXINN.

Tax Migration as a prequisition to legal change GST.1. The TAXINJ tax procedure is currently in use. What are the prerequisite changes that need to be ... Configure SAP Cash Journal

Configure SAP Cash Journal

In the SAP SAP tutorial, we will learn the step-by-step procedures to configure SAP Cash Journal with proper screenshots of every configuration s ... Configure the Electronic Bank and Manual Bank Statement

Configure the Electronic Bank and Manual Bank Statement

Electronic bank statement – It is an electronic document sent by the bank which gives details of the transactions done by the account holder. Th ... Transactions FBL1N/ FBL3N/ FBL5N or as of ERP2004 FAGLL03: Defining Special Fields

Transactions FBL1N/ FBL3N/ FBL5N or as of ERP2004 FAGLL03: Defining Special Fields

How to define Special Fields for the Line Item Transactions FBL1N/ FBL3N/ FBL5N or as of ERP2004 FAGLL03?I. Basic information1. Depending on your rele ... TAX and Pricing Procedure Configuration for GST

TAX and Pricing Procedure Configuration for GST

Tax Procedure Configuration for GST 1) Create Condition Table These condition table combinations are for user reference with the help of these a ....jpg) Configuration of Foreign Exchange

Configuration of Foreign Exchange

Foreign Currency Valuation Configuration Step-I: Define standard quotation for exchange rate Path: General Setting> Currencies> Defi ... Define Document Number Range

Define Document Number Range

T-code(FBN1)PathFinancial Accounting -> Financial Accounting Global Setting -> Documents -> Document Number Ranges -> Define/Copy (co code ... Asset Accounting (FI/AA) Create view

Asset Accounting (FI/AA) Create view

Organizational Structure:Check- Country Specific SettingsMaximum LVA amount for posting: Here we define the maximum amount for checking posting to low ... SAP FICO Tree Menu

SAP FICO Tree Menu

Sap tree_ficoSAP standard menu||-- Office|-- Logistics|-- Accounting| || |-- Financial accounting| | || | |-- General ledger| | | || | | |-- Document ... Leading ledger vs Non-leading ledger in ECC 6.0

Leading ledger vs Non-leading ledger in ECC 6.0

Difference between Leading ledger and Non- leading ledger New General Ledger has all functions of the Classic General Ledger but has been enhance ... Define Document Types

Define Document Types

What is Document Types in SAP? Document type is a key used for classifying accounting documents & differentiate between trade transactions to b ... Configuring Withholding Tax (TDS)

Configuring Withholding Tax (TDS)

Two types of Withholding tax. Classic and Extended. Classic W/T means when the tax is deducted only at the time of payment and extended W/T means when ... Open and Close posting Periods

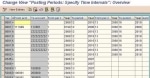

Open and Close posting Periods

Posting periods in fiscal year variants are used to establish a framework for managing your financial activities. You have the ability to define these ... Business Process Procedure (BPP)

Answered

Business Process Procedure (BPP)

Answered

Business Process ProcedureBPP is Business Process Procedure. It is created at the time of configuration and it helps other Consultants to know what ha ... Define Posting Rules for Bank Transactions

Define Posting Rules for Bank Transactions

What is Posting Rules? Posting Rules in SAP are used to determine how financial transactions are posted to different accounts. A posting rule is a ...- Work Flow Creation Steps

How to create WorkflowTrigger custom workflow when a Document is ParkedIntroductionThis document shows step by step process for the creation of workfl ...  FICO Bank Accounting Configuration

FICO Bank Accounting Configuration

Bank Accounting: Bank accounting is a module in SAP which maintains the accounting transactions processed with the associated bank. This account ... Tax on Sales/Purchases

Tax on Sales/Purchases

Configuration Steps 1. Check Calculation Procedure 2. Assign Country to Calculation Procedure 3. Check and Change Settings for Tax Processing 4. Speci ... Automatic Payment Program (T Code FBZP)

Automatic Payment Program (T Code FBZP)

Automatic Payment Program (T Code FBZP)..........................................................................1 1. Set up all Company Code for pay ... Define Posting Keys

Define Posting Keys

T-code(OB41)PathFinancial Accounting Financial Accounting global Setting Document Line Items ...- What are Functional Specifications?

Functional specifications (functional specs), in the end, are the blueprint for how you want a particular report and transaction to look and work. It ...

×