Fiscal Year

Fiscal Year is nothing but the accounting period which normally spreads over 12 months. The financial statements are drawn for a fiscal year in SAP. In SAP Fiscal year is defined as Fiscal Year Variant.

In SAP Fiscal year can be defined as year independent and year dependent.

- Year Dependent: In this, periods can vary from year to year.

- Year Independent: In this one can make the same number and dates for periods each year.

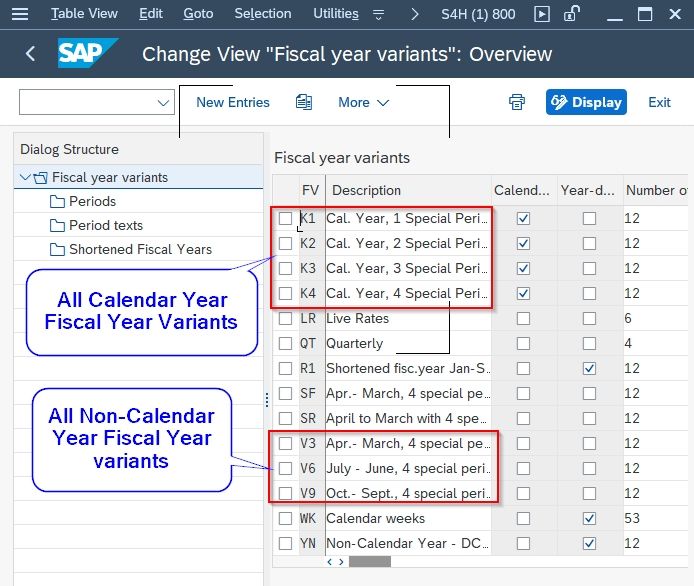

All Calendar Year Fiscal Year Variants in SAP are denoted usually as K1, K2, K3, and K4. All Non-Calendar Year Fiscal Year variants - Fiscal year may or may not correspond to the calendar year are denoted by V3, V6, and V9. In SAP K4 is the standard Calendar year variant and V3 is the standard non Calendar year variant.

Fiscal Year Variant

Fiscal Year Variant in SAP is a fiscal year that can be defined as a time period used to make the financial statements within an organization. This Fiscal Year Variant holds the total 16 numbers of posting periods in which 12 normal posting periods and 4 special periods. For a fiscal year, one can only define 16 posting periods in every one year within CO (Controlling Component) by a start date and end date. Special periods are special so one can use them for year-end activities. T. Code – OB29 is used for the Fiscal Year Variant.

Steps to configure Fiscal Year Variant:

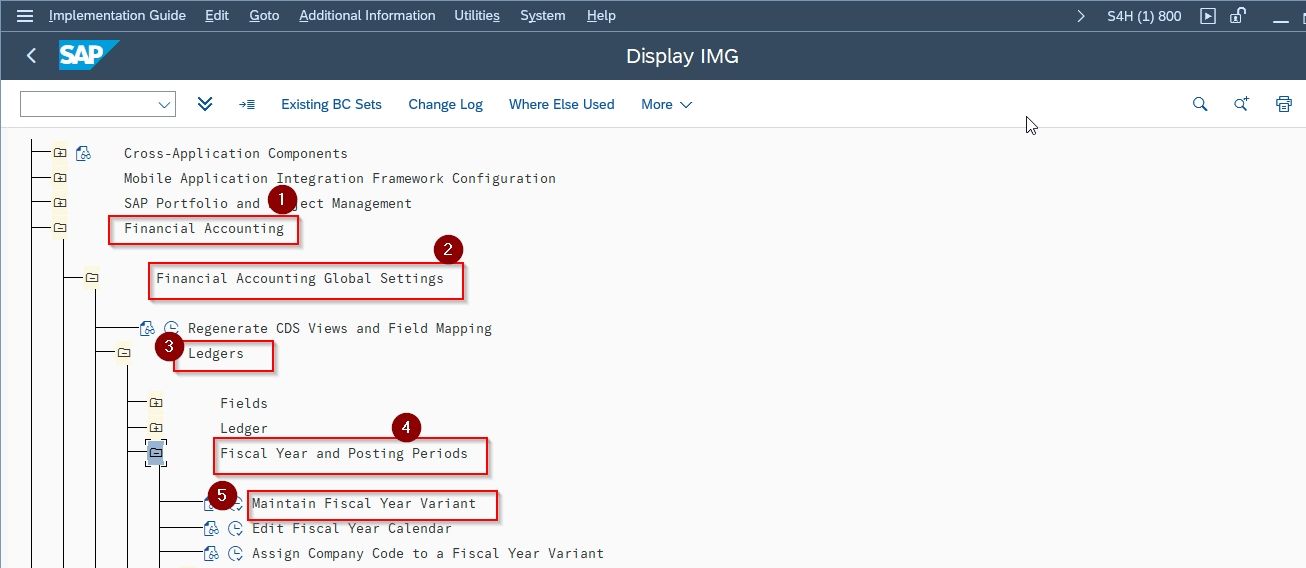

Step 1: Goto IMG path:

SPRO >> SAP IMG >> Financial Accounting (FI) >> Financial Accounting Global Settings >> Ledgers >> Fiscal Year and Posting Periods >> Maintain Fiscal Year Variant.

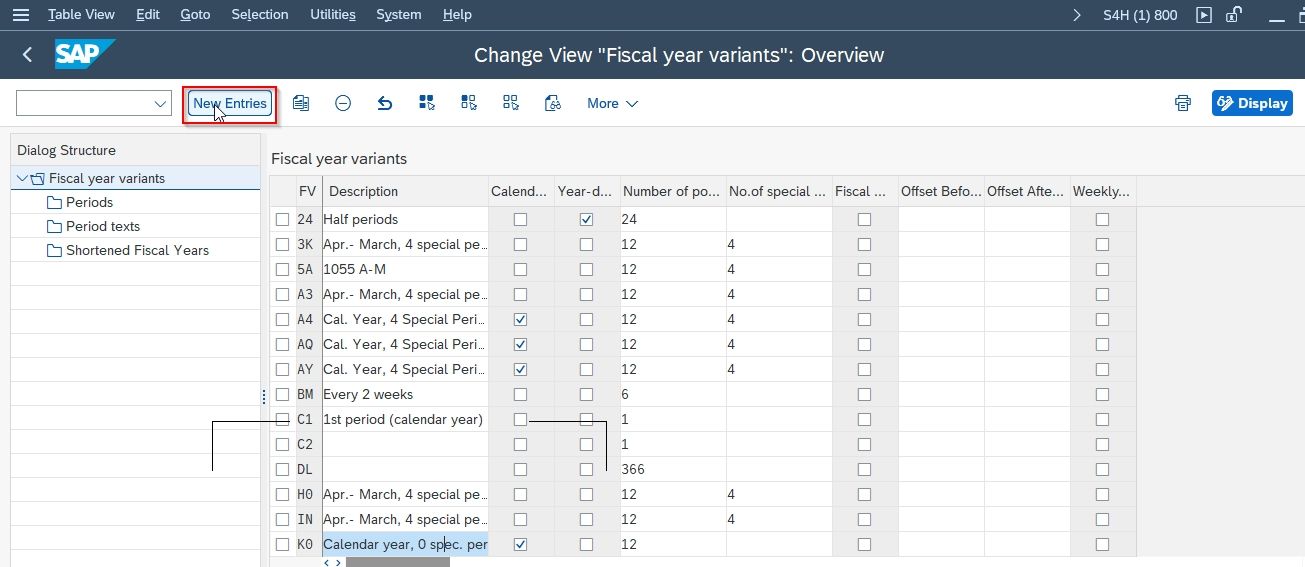

Step 2: On the Change View “Fiscal year variants”:Overview screen click the New Entries button.

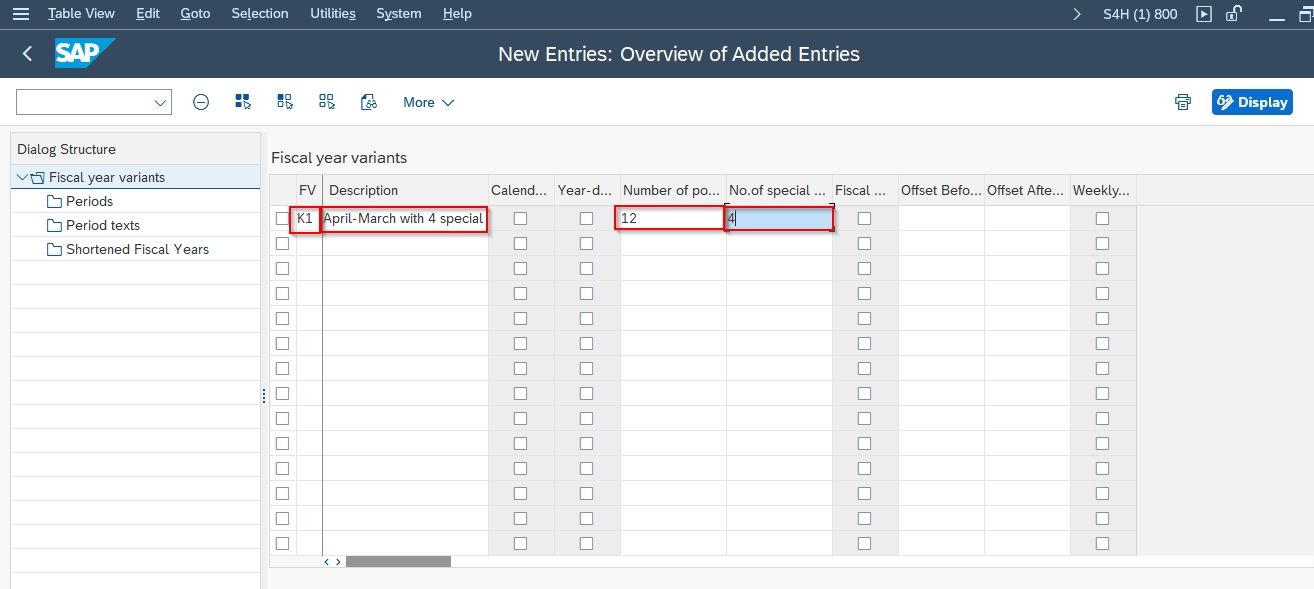

Step 3: On the New Entries: Overview of Added Entries screen updates the following fields.

- FV: Here you can give any name to the fiscal year variant for the posting period. For e.g FT.

- Description: Here you can give the description of the fiscal year variant used by your company. For e.g April to March with 4 special periods.

- No.of Posting periods: The number of years for which you are making the entries.

- No. of Special periods: The number of years for which you want to make special entries, can be 4 years maximum. Special periods are mainly required for making adjustment entries. For e.g, at the end of the year, you realize some entries are missing or some new entries are required or some entries need to be rectified in such cases special periods are required to make adjustment entries.

After making the entries press the Save button and your Fiscal Year Variant is successfully created.

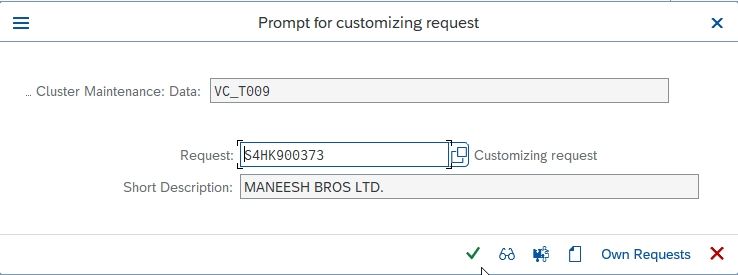

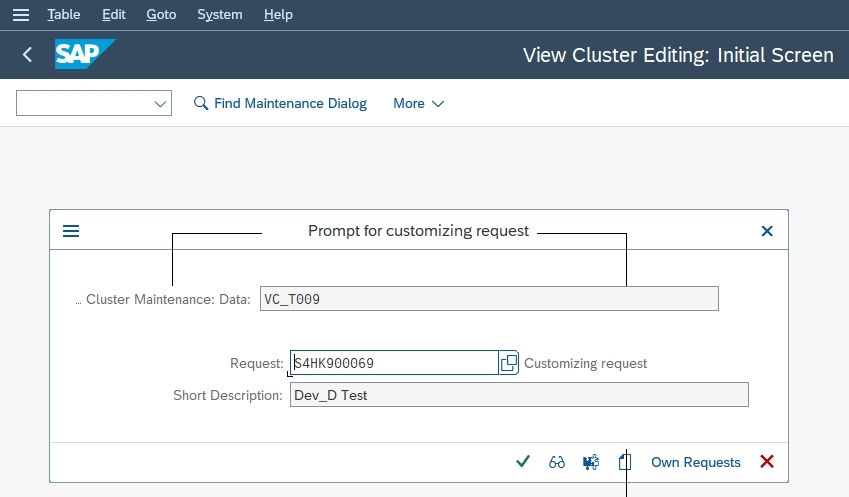

Press the tick button on View Cluster Editing: Initial Screen.

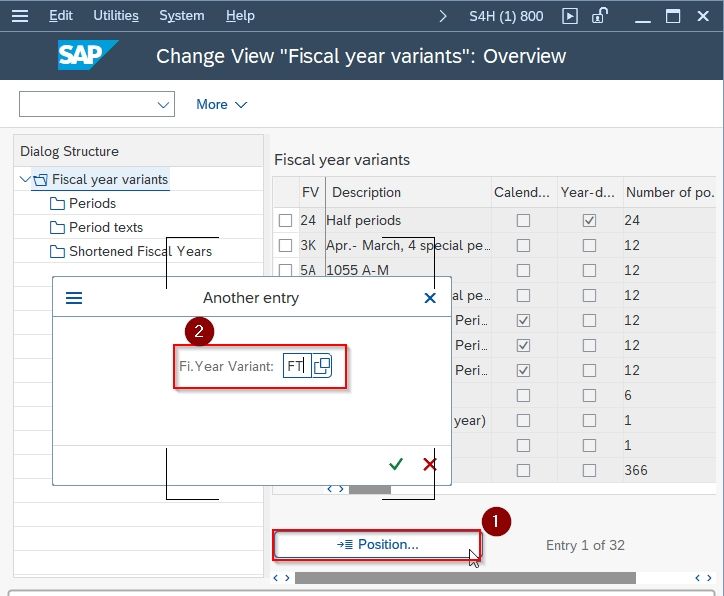

Step 4: Go back to the Change View “Fiscal year variants”: Overview screen and press the Position button then Another entry screen appears where you type the name of the Fi Year Variant you created as FT and press the tick button

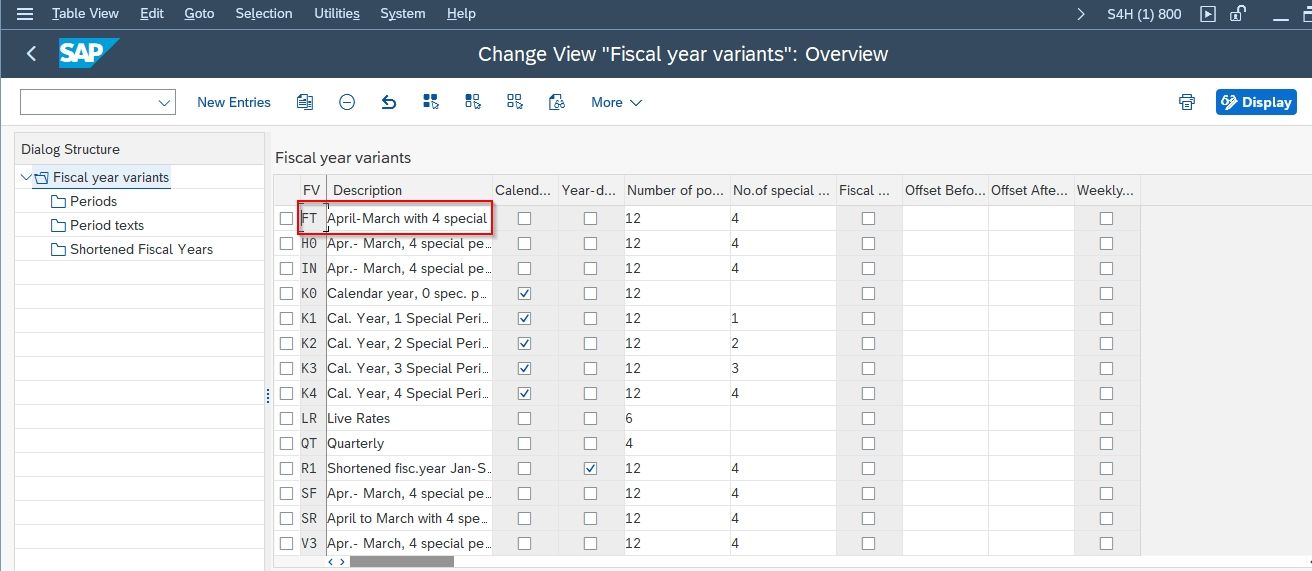

Now you can see the which you created in the list.

How to define Posting periods

Steps to define posting period:

After creating the Fiscal Year Variant you have to define the posting period

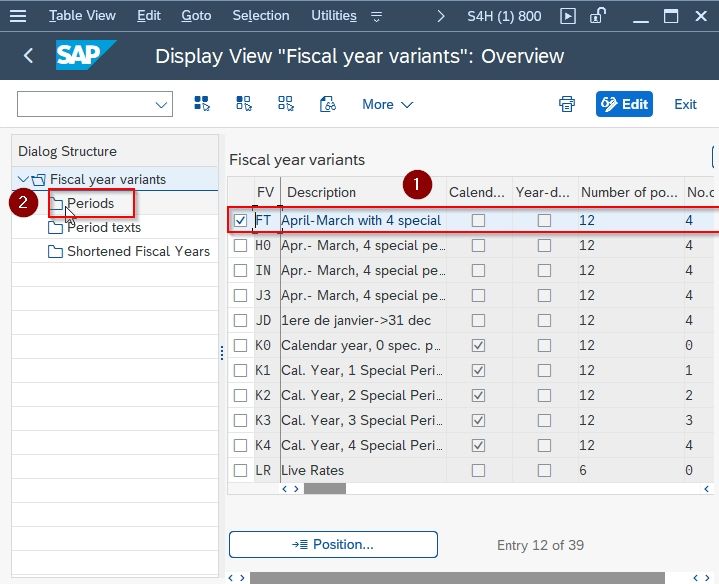

Step 1: On Display View “Fiscal year variants”: Overview screen select the Fiscal year variant FT which you created and select the Periods button.

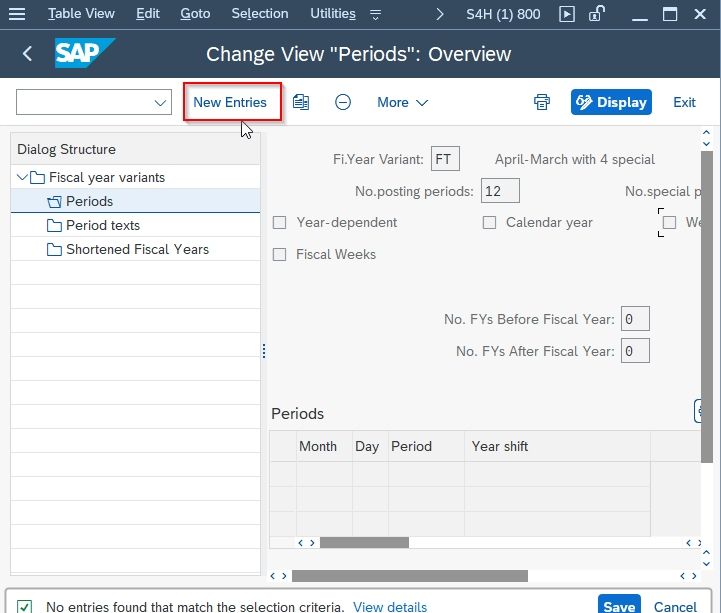

Step 2: On Change View “Periods”: Overview screen select New Entries button to make entries for the period of fiscal year variant.

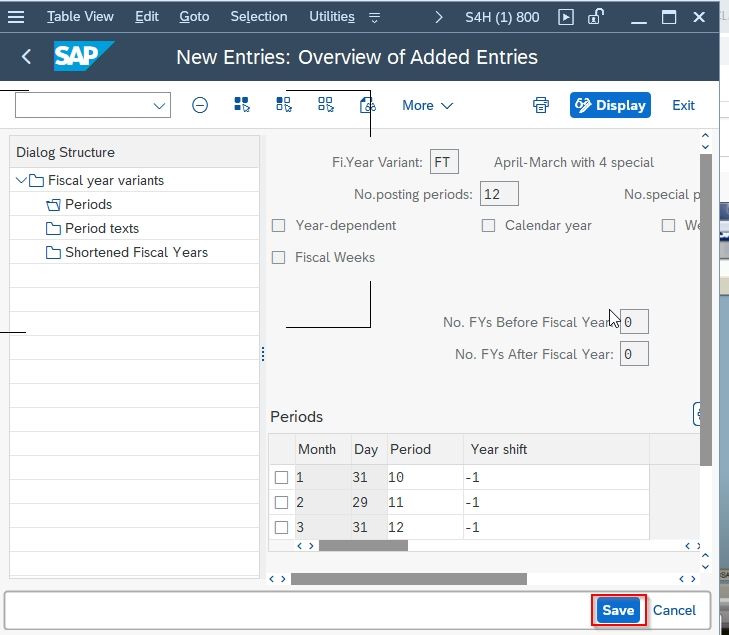

Step 3: Now update the following fields on the New Entries: Overview of Added Entries screen:

As our posting period is the non-calendar year we take 12 months from January to December. After that, we mention how many days in each month for e.g in 1st month January there are 31 days.

As our period starts from April it becomes the 1st month so in the period we define April as the 1st month. In the year we count 1st month January as the previous year and April as the current year so the year shift in January, February, and March is -1, and April to December is 0.

For example, suppose if we are making entries for the posting period 2021 then we take the 4th-month April 2021 as the 1 month for our posting period that's why the year shift is 0 and 1st month January as the 10th month of the posting period 2021 and year shift is -1.

| Month | Day | Period | Year shift |

| 1 | 31 | 10 | -1 |

| 2 | 29 | 11 | -1 |

| 3 | 31 | 12 | -1 |

| 4 | 30 | 1 | 0 |

| 5 | 31 | 2 | 0 |

| 6 | 30 | 3 | 0 |

| 7 | 31 | 4 | 0 |

| 8 | 31 | 5 | 0 |

| 9 | 30 | 6 | 0 |

| 10 | 31 | 7 | 0 |

| 11 | 30 | 8 | 0 |

| 12 | 31 | 9 | 0 |

Now press the save button. On Prompt for customizing request screen press, the tick button and period are successfully posted for the Fiscal year variant.