What is GST? SAP GST Interview Questions and AnswersSAP GST STO ConfigurationSAP GST Training Tutorials for BeginnersSAP ASP for GST IndiaMaintain HSN Code In SAPSAP GSTIN Number Cannot be SavedGST Configuration in SAPSAP Tax Tariff Code in Service MasterSAP GST Vendor ClassificationSAP ISD Process GSTIN ConfigurationGST Import Process in SAPSAP GST Reverse Charge MechanismSAP GST ODN Number ConfigurationSAP GST Business Place ConfigurationSAP GST Tax Indicator (TAXIM) FieldsSAP J_1ig_inv Table for STOSmart Form Invoice For GSTSAP GST Withholding TDS ConfigurationSAP GST Vendor Down Payment SAP GST Customer Down Payment HSN/SAC code for repair & maintenance services

Tutorials

- What is GST?

- SAP GST Interview Questions and Answers

- SAP GST STO Configuration

- SAP GST Training Tutorials for Beginners

- SAP ASP for GST India

- Maintain HSN Code In SAP

- SAP GSTIN Number Cannot be Saved

- GST Configuration in SAP

- SAP Tax Tariff Code in Service Master

- SAP GST Vendor Classification

- SAP ISD Process GSTIN Configuration

- GST Import Process in SAP

- SAP GST Reverse Charge Mechanism

- SAP GST ODN Number Configuration

- SAP GST Business Place Configuration

- SAP GST Tax Indicator (TAXIM) Fields

- SAP J_1ig_inv Table for STO

- Smart Form Invoice For GST

- SAP GST Withholding TDS Configuration

- SAP GST Vendor Down Payment

- SAP GST Customer Down Payment

- HSN/SAC code for repair & maintenance services

GST (Goods And Service Tax) Tutorial

Configure STO (Stock Transfer Order) process for GST

Configure STO (Stock Transfer Order) process for GST

This tutorial explains the configuration process of setting up STO (Stock Transfer Order) process for GST India.Configure Plant as a VendorThe plant t ... GST IN Procurement Configuration in SAP

GST IN Procurement Configuration in SAP

Configuration for Procurement Condition table maintenance Executing the t-code M/03 Source combination: Country/Region/PlntRegion/GST Clas ... Official Document Numbering (ODN) Configuration for GSTIN

Official Document Numbering (ODN) Configuration for GSTIN

How to Configure Official Document Numbering (ODN)?This tutorial explains how to configure Official Document Numbering (ODN) for GST India.Document Cl ... Reverse Charge Tax Configuration Mechanism for GST IN

Reverse Charge Tax Configuration Mechanism for GST IN

Reverse Charge Tax Configuration Scenario For GST IndiaConfiguration for ProcurementCondition types1.Deductible reverse charge condition typesBelow ar ... GST Vendor classification issue in FV11

GST Vendor classification issue in FV11

Error: Fill in all required entry fieldsGST vendor classification does not accept any blank value and gives an error 'Fill in all required entry f ... SAP offers ASP for GST India

SAP offers ASP for GST India

The GST India administration will have two major players: GST Suvidha Provider (GSP) Application Service Provider (ASP)Read more here Indian Tax ... Import Process For GST India

Import Process For GST India

What are the steps involved in GST India Imports Scenario???The process involved in GST import scenario are: First, create a purchase order, Purchase ... Input Service Distribution (ISD) Process GSTIN

Answered

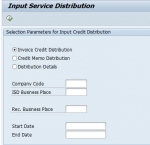

Input Service Distribution (ISD) Process GSTIN

Answered

What is the process Involved in Input Service Distribution (ISD) for GST India?SOLUTIONBelow are the steps involved in Input Service Distribution ... Tax Configuration (Withholding TDS) for GSTIN

Tax Configuration (Withholding TDS) for GSTIN

Steps to create official withholding tax keys Please follow the steps below: Execute t-code SPRO in SAP command field Next, click the SAP ... Tax Indicator (TAXIM) Fields for GST IN

Tax Indicator (TAXIM) Fields for GST IN

What is the Tax Indicator fields used for GST India in SAP standard system?SOLUTION1) SAP has allotted tax indicators, 0,1,2 and 3 as the part of the ... External Service Management for SAP GST MM India

External Service Management for SAP GST MM India

Taxes activated for Individual service line item level:1.Navigate to SPRO Path in order to maintain Taxes at service line item level.IMG->Material ... Data Dictionary Activities

Data Dictionary Activities

Changes to Existing Domain First execute transaction SE11 and give domain name as ‘J_1ICONDNAME1’ and click on ‘Change&rsq ... Extend Pricing Structures KOMP and KOMG

Extend Pricing Structures KOMP and KOMG

How to extend pricing structure KOMP and KOMG?SOLUTIONExtending Pricing Structure KOMP Please follow the steps below for extending the pricing st ... Tax Procedure Configuration for Sales and Distribution

Tax Procedure Configuration for Sales and Distribution

Maintaining Condition TableExecute the transaction V/03 Source Combination : Country/ PlntRegion/ TaxCl1Cust/ TaxCl.Mat/Region/ Ctrl codeSource c ... Post Implementation Steps for STO (Stock Transfer Order) GSTIN

Post Implementation Steps for STO (Stock Transfer Order) GSTIN

STO (Stock Transfer Order) Post Implementation Steps for GST IndiaCreate PF status J_1IG_STO_STATPlease follow the step below in order to create PF st ... BADI INVOICE_UPDATE Implementation GSTIN

BADI INVOICE_UPDATE Implementation GSTIN

Create Implementation For BADI INVOICE_UPDATE in GST IndiaPlease follow the step below in order to create an implementation for BAdI INVOICE_UPDA ... BADI_SD_SALES_ITEM GST Implementation

BADI_SD_SALES_ITEM GST Implementation

1.First, execute transaction code SE18 and then enter the BADI ‘BADI_SD_SALES_ITEM’ and select ‘Display’ button2.Now please cl ...- Vendor Down Payment GSTIN

How to clear line for Vendor down payment for GST India?Following are the steps involved in for Vendors Down payment: First, configure Vendor down pay ... - Customer Down Payment GSTIN

How to clear line for Customer down payments for GST India?Following are the steps involved in for Customers Down payment: First, configure customer d ...  Create Smart Form Invoice For GSTIN

Create Smart Form Invoice For GSTIN

How to create Smart Form for GST (Goods and Services Tax) India?SOLUTIONPlease follow the steps below in order to create Smart Form for GST India Firs ...

1

×