Configuration for Procurement

Condition table maintenance

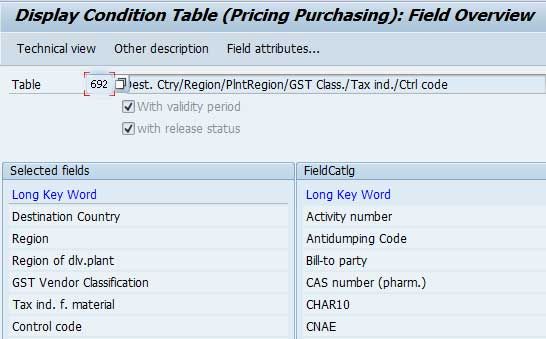

Executing the t-code M/03

- Source combination: Country/Region/PlntRegion/GST Class./Tax ind./Ctrl code

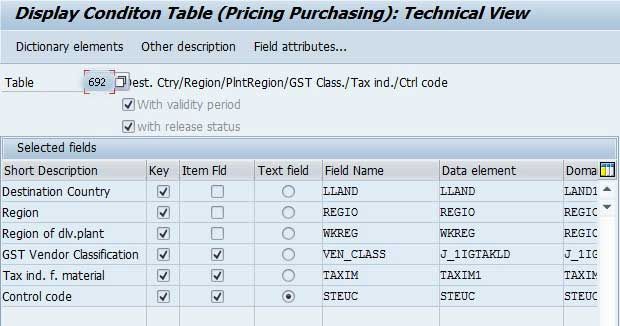

Technical View:

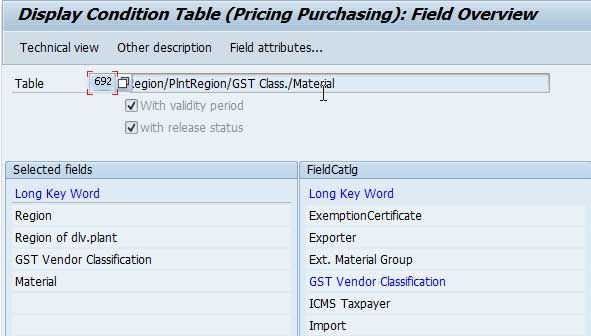

- Source combination: Region/PlntRegion/GST Class./Material

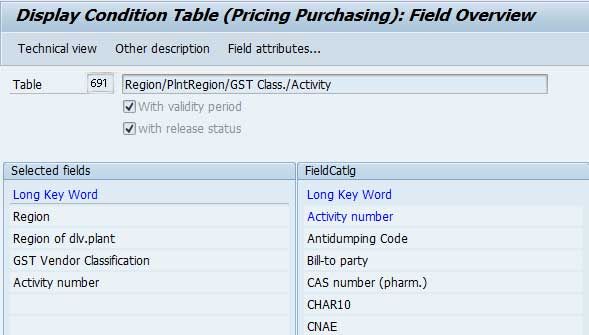

- Source combination: Region/PlntRegion/GST Class./Activity

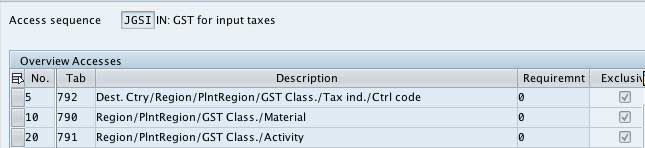

Access Sequence Maintenance

Executing the t-code OBQ2

Source Access sequence - JGSI– IN: GST for input taxes

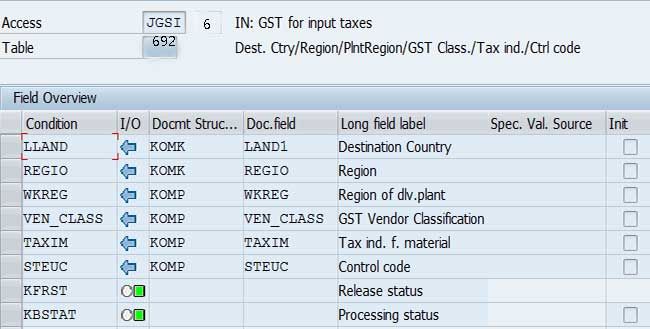

Field Assignment:

Please make sure that you Assign WKREG to KOMP

Condition Types

Make the following settings for the condition-based tax procedure TAXINN:

Create the following condition types for GST

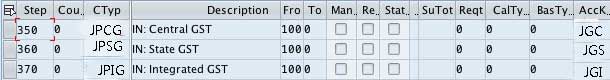

Condition types for Deductible GST

- JPCG - IN: Central GST

- JPSG - IN: State GST

- JPIG - IN: Integrated GST

- JPUG - IN: Union Ter. GST Execute the transaction OBQ1

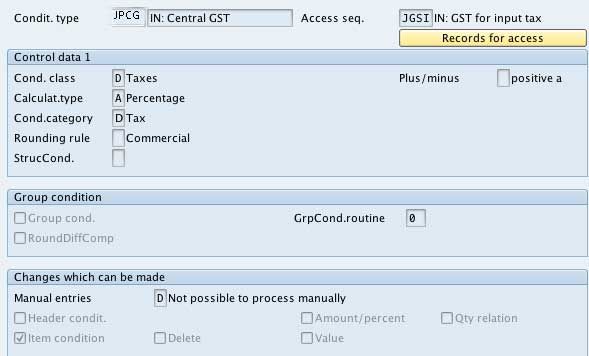

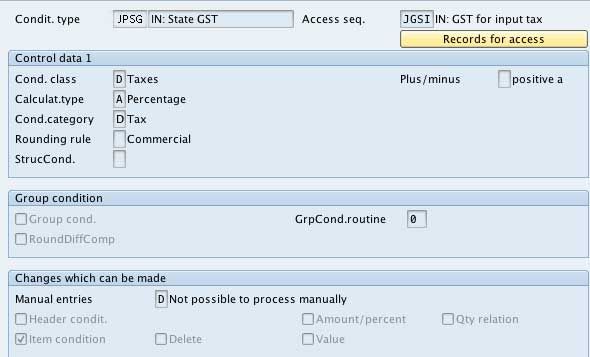

Executing the t-code OBQ1

Condition type for Central GST - JPCG - IN: Central GST

Condition type for State GST - JPSG - IN: State GST

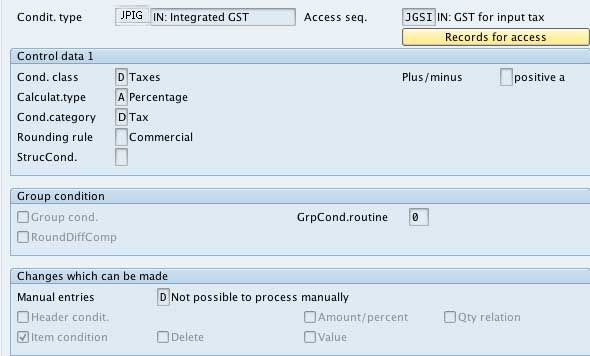

Condition type for Integrated GST - JPIG - IN: Integrated GST

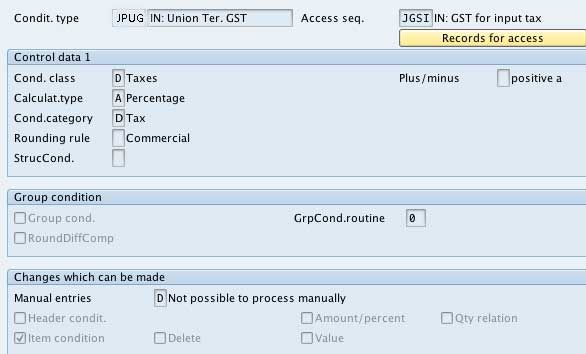

Condition type for Union Territory GST - JPUG - IN: Union Ter. GST

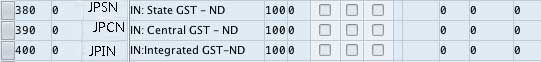

Condition types for Non-Deductible Taxes

- JPSN - IN: State GST - ND

- JPCN- IN: Central GST - ND

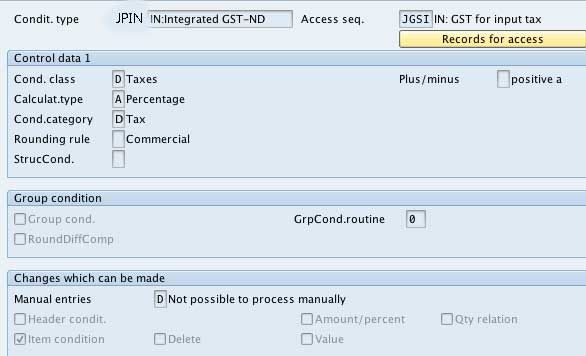

- JPIN - IN: Integrated GST-ND

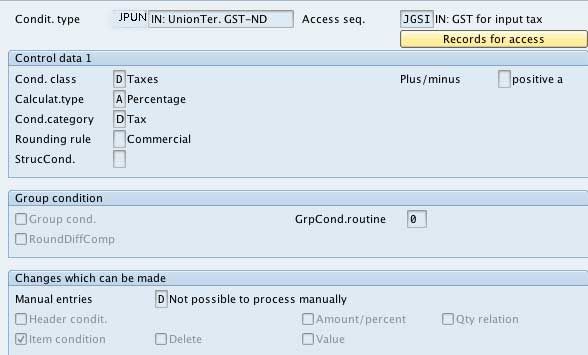

- JPUN - IN: UnionTer. GST-ND

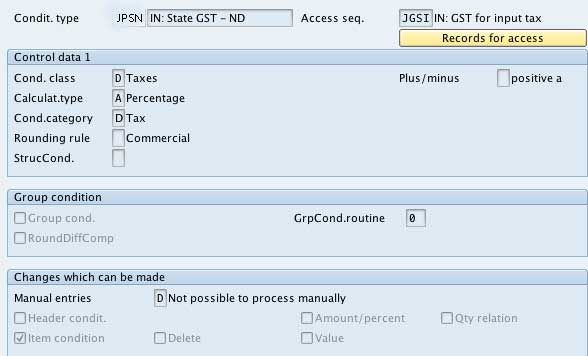

Condition type for Non-deductible state GST - JPSN - IN: State GST - ND

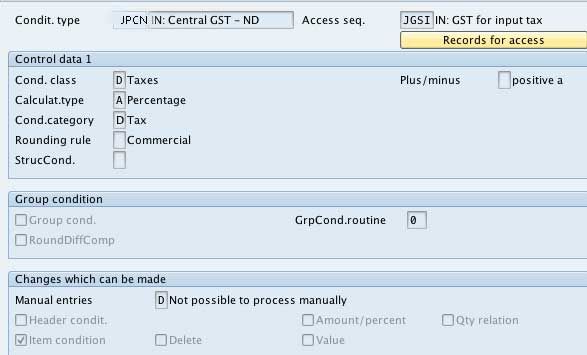

Condition type for Non-deductible central GST - JPCN - IN: Central GST - ND

Condition type for Non-deductible central GST - JPIN - IN:Integrated GST-ND

Condition type for Non-deductible central GST - JPUN - IN: UnionTer. GST-ND

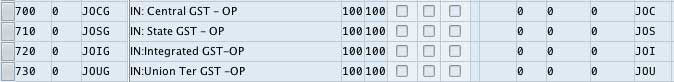

Accounting Keys

Executing T-code OBQ1

Deductible Condition Types Accounting keys

|

Account Key |

Corresponding deductible condition type |

|

JGS – State GST |

JPSG - IN: State GST |

|

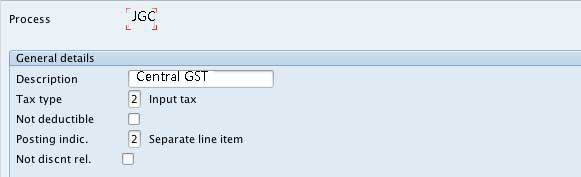

JGC - Central GST |

JPCG - IN: Central GST |

|

JGI - Integrated GST |

JPIG - IN: Integrated GST |

|

JGU - Union Territory GST |

JPUG - IN: Union Ter. GST |

Reference Accounting key maintenance for JGC account key:

Non- Deductible Condition Types Accounting keys

|

Account Key |

Corresponding non-deductible condition type |

|

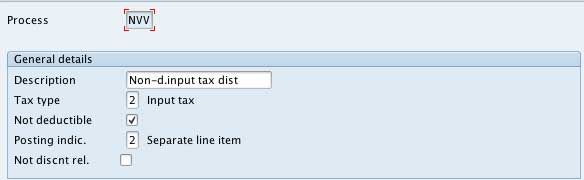

NVV – Non-d.input tax dist |

JPSN - IN: State GST - ND |

|

NVV – Non-d.input tax dist |

JPCN- IN: Central GST - ND |

|

NVV – Non-d.input tax dist |

JPIN - IN:Integrated GST-ND |

|

NVV – Non-d.input tax dist |

JPUN - IN: UnionTer. GST-ND |

Updating Tax Procedure - TAXINN

Execute the transaction OBQ3

Please as shown below maintain the defined condition types and account keys in the tax procedure:.

Note: This is an example of GST conditions only steps may vary from actual.

Please also maintain the output tax conditions in TAXINN procedure for direct FI postings

Condition Records Maintenance

Executing the t-code FV11

Please also maintain the tax rates as per the defined access sequence.

Classify Condition Types

Now classify the condition types in the view - J_1IEXCDEFN through the T-code SM30

| Proc. | CTyp | Condition Name |

| TAXINN | JGCG | CGSTSOFFAP |

| TAXINN | JGSG | SGSTSOFFAP |

| TAXINN | JGIG | IGSTSOFFAP |

| TAXINN | JGUG | UGSTSOFVAP |

| TAXINN | JGIN | INSTSOFVAP |

| TAXINN | JGCN | CNSTSOFVAP |

| TAXINN | JGSN | SGSTINVAP |

| TAXINN | JGUN | UTGSTINVAP |

| TAXINN | JOCG | CGSTAR |

| TAXINN | JOIG | IGSTAR |

| TAXINN | JOSG | SGSTAR |

| TAXINN | JOUG | UTGSTAR |