How Payroll Updates FI/CO?

Most people misunderstand how Payroll updates FI/CO?

- “Payroll updates FI/CO automatically just like MM and SD automatically update FI/CO, right?”

- WRONG!

Some Payroll-to-FI/CO data must be transferred manually

- Payroll and FI/CO have defined integration points through which data is passed, just like MM/SD

- Unlike MM/SD, though, some integration points require human intervention

- This causes a lot of confusion between the Payroll and FI/CO teams during both the implementation and after go-live

Payroll-FI/CO Integration Points

The integration points between Payroll and FI/CO are:

- Creating the DME (payments)- automatic (check register only)

- Posting to Accounting - manual

- Posting third-party Remittance – automatic

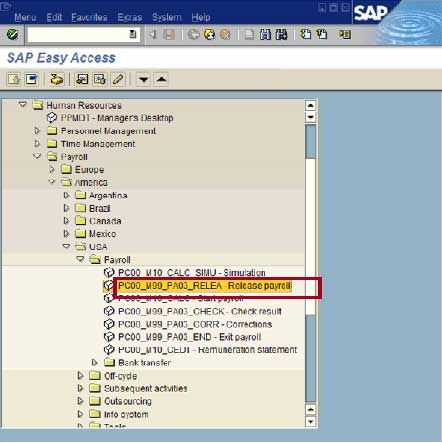

Running the Payroll - Calculation Steps:

- First, we’ll release the payroll: This sets a system parameter that allows the payroll to be run. In this step you select the payroll area and payroll dates you are processing.

- Next, we’ll select “Start payroll”, enter screen parameters and launch the payroll process: This will generate wage types and assign cost centers. We’ll check the results by viewing the Remuneration statement.

- Finally, we’ll select the “Exit payroll” step: This sets payroll process system parameter to “finalized”, so additional processing may be completed.

Note: None of these steps will update FI/CO in any way

Creating DME - Payments

Next, we’ll create the Data Medium Exchange (DME). This step prepares the payroll remuneration data for ACH & check printing. You specify one of the following DME types:

- Payroll Check

- ACH Transfer (Direct Deposit)

- Wire Transfer

Payroll uses the A/P Payment Program for the ACH and check printing processes.

- The check register will be updated.

- In contrast to A/P payments, the G/L (FI/CO) will not be updated.

After doing this, your check register will be out of balance with your outgoing payments G/L account in FI/CO. FI/CO will also be out of balance with Payroll because no expense or liability postings will have been transferred yet.

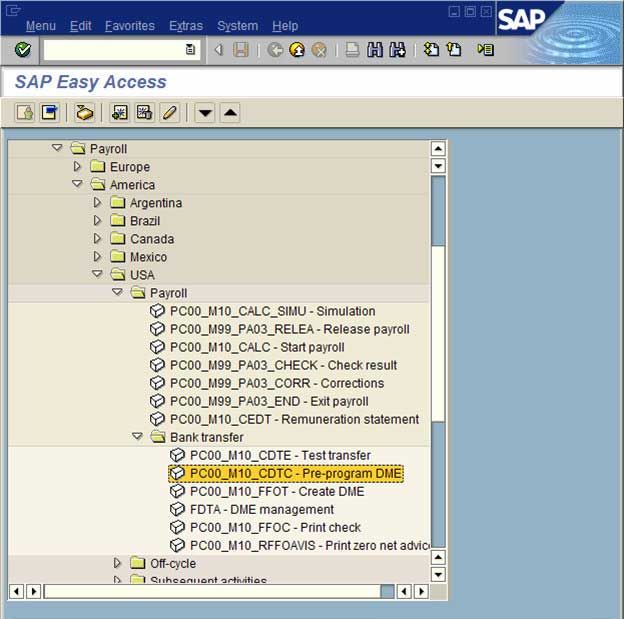

How to Generate the DME?

- Create Pre-Program DME

- Create DME

- DME Management

- Run payment program to print/generate DME

The results:

- Payroll checks and ACH files for the direct deposit were generated

- The check register has been updated and reflects the newly printed payroll checks, but FI/CO has no payroll information!

Conclusions:

You can run payroll and generate checks without transferring to FI/CO. In other words: you can successfully run the payroll, cut the payroll checks, and distribute them to employees without updating FI/CO at all!

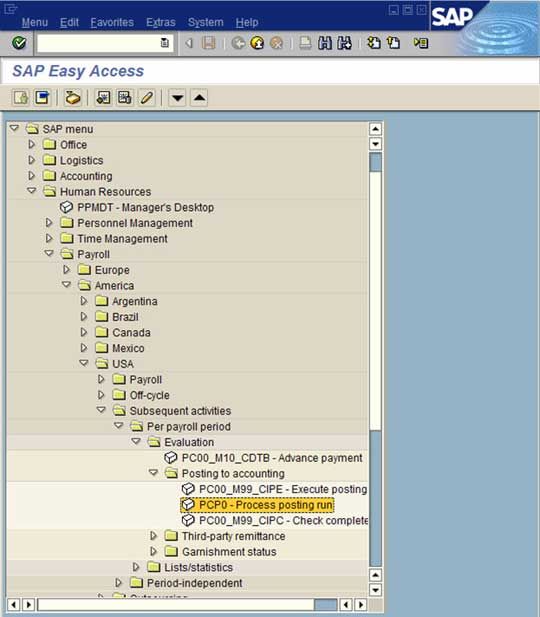

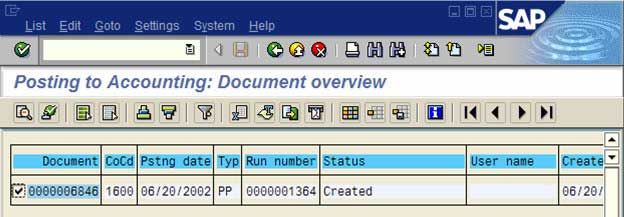

Post To Accounting

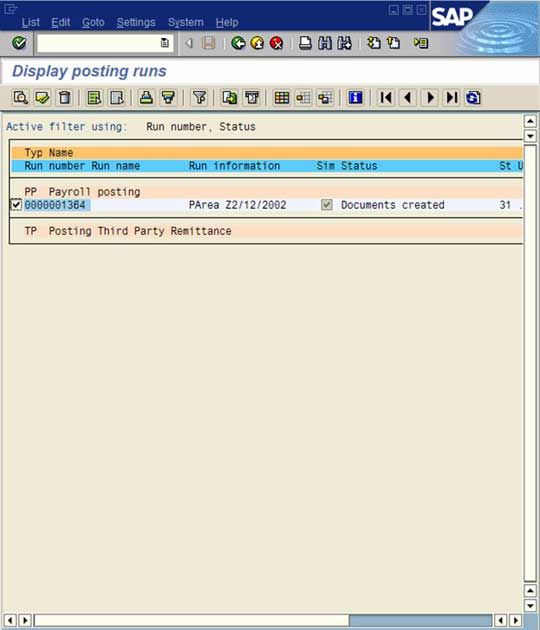

To solve this Payroll-FI/CO discrepancy, we’ll “manually” execute transaction PCP0. This is an important, separate step after generating payroll and cutting checks (DME).

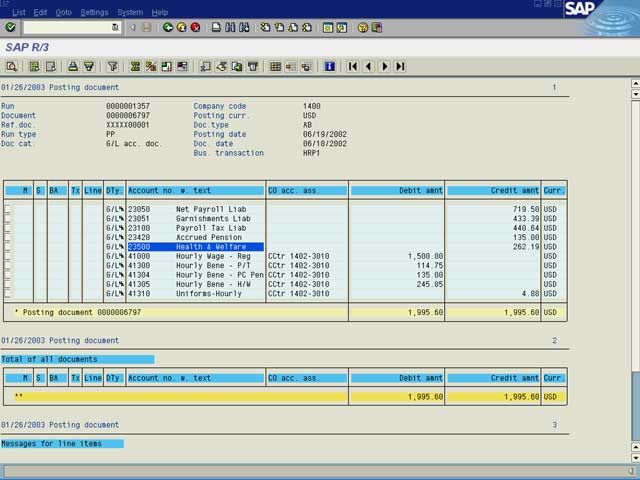

PCP0 updates FI/CO – Expenses, Liabilities and Assets:

- It uses the employee’s home cost center to determine the cost center to post to.

- It uses the mapping of wage types to symbolic accounts to G/L accounts to determine the correct G/L account/cost element to use.

- I'll explain these elements and relationships in detail later.

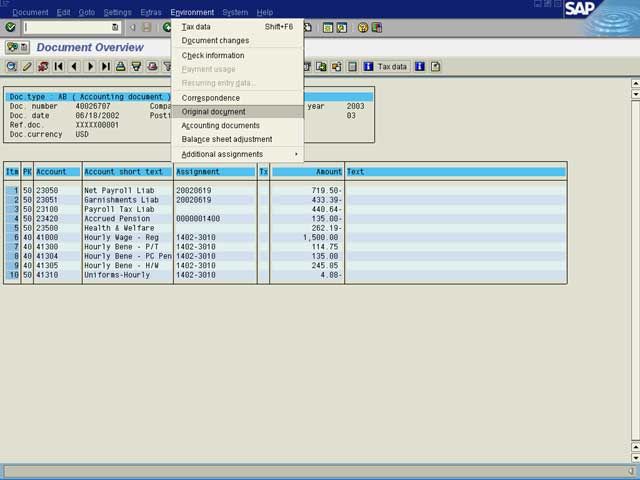

Note: When viewing the FI/CO update document, use menu path Extras>Original Document to jump to the payroll Remuneration statement (which lists the wage types/employees that make up the FI/CO posting).

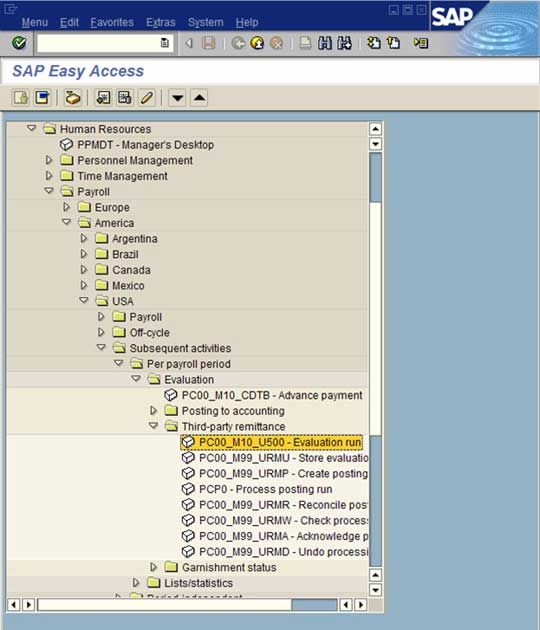

Third-Party Remittances

R/3 allows you to automatically create payables to different vendors as a result of HR/Payroll. Examples include:

- Garnishment Processors

- Taxing Authorities

- Benefit Providers

This is a separate step done after payroll and the update of payroll results to FI/CO:

- Posting third-party Remittances isn’t required to run the next payroll

- Employee withholdings such as garnishments can NOT be passed to the A/P vendor if the third-party Remittance Posting Run is not executed.

- In this step the Integration Is Automatic. Once you post your third-party Remittances, the proper A/P vendors accounts are updated so that you can process them like any other liability through the A/P payment program.

Posting With CATS

CATS = Cross-Application Timesheet

- Time Capture and Data Transfer Tool

- Is an additional piece of functionality that can be used for Payroll and FI/CO

CATS can be used as the time transfer tool to update HR/Payroll with hours worked by employee

CATS can be used to enter one-time earnings/deductions for employees

Using CATS you can capture an employee’s time across different cost centers (projects, etc.)

- Update HR, CO or both with time worked by employee by activity

CATS updates HR/Payroll

- CATS feeds the payroll system with the actual hours worked and one-time earnings/deductions for a pay period

- CATS is very helpful for hourly paid employees

CATS updates CO

- Updates CO with the hours actually worked by cost center for an employee

- The payroll expense posting for an employee is sent to the employee’s home cost center in the Payroll to FI/CO Update

- Using CATS you can create an activity allocation to credit the home cost center for hours not worked by the employee and debit the cost centers where the employee actually worked

An Example

- Employee John works 80 hours over a two-week pay period

- John is an hourly employee who makes $15/hour and is assigned to costcenter 123-A as his home cost center

- John’s company uses CATS as a time entry/capture tool

- Over the two-week period John worked 40 hours in cost-center 345-B, 30 hours in cost-center 678-A, and 10 hours in his home cost-center 123-A

- His gross pay for the period is 80hours*15/hr = $1200

- From the Payroll to FI/CO transfer – John’s home cost-center 123-A is debited $1200 (the entire 80 hours that he worked)

- The CATS interface will credit John’s home cost-center 123-A 70 hours -- (times a pre-defined activity rate - $15/hr) $1050 – via an internal activity allocation. This will leave a net debit of $150 (10hrs * 15/hr) on John’s home center

- The other side of the CATS interface activity allocation will debit cost-center 345-B 40 hours for a total of $600, and debit cost-center 678-A 30 hours for a total of $450

Conclusions:

- CATS is a great tool to use when you have hourly employees, especially when these employees can do work over several projects or cost-centers. CATS even allows you to “charge” the worked cost-centers for different activity rates depending on the type of work/project the employee is working on.

- CATS allows you to spread costs over the cost-centers actually worked, instead of the employee’s home cost-center which is the SAP default when posting from Payroll to FI/CO.

Configuring the Payment Program

As was shown in the previous section, Payroll uses the A/P payment program to generate checks and ACH payments (DME). You use the same configuration techniques that you use for A/P.

- Create House Bank and Accounts

- Create Payment Methods

- Assign to Accounts

- Create RFFOUS_C and RFFOUS_T variants

Even if you don’t use different bank accounts for A/P payments and payroll payments you should create a new payment method for payroll check and ACH transfers:

- Enables easier reconciliation of checks, accounts, and check register to G/L

- Allows you to have a greater degree of authorization to view/create/change payroll checks

Mapping Payroll Components to FI/CO – Integration Point Configuration

In this section we’ll show the configuration behind the Payroll – FI/CO integration points:

- Defining Wage Types (Gross to Net)

- Defining Symbolic Accounts

- Mapping Wage Types to Symbolic Accounts

- Mapping Symbolic Accounts to the G/L

- HR Payee Payees to Vendor Accounts (for Garnishments and third-party Remittances)

Step 1 - Defining Wage Types

Wage Types are elements used in the payroll schema to represent different types of payroll activities (e.g., wages, deductions, taxes):

- Wage types for gross wages, net wages, and taxes are delivered standard and ready to use

- Employee deductions and earning codes are delivered as examples

- Wage types are created or modified by the Payroll team

The payroll schema uses wage types to calculate Net Payroll from Gross Payroll:

- Similar to SD condition types and pricing procedures

- The wage types used in payroll are what will ultimately drive our G/L postings and accounts used in FI/CO

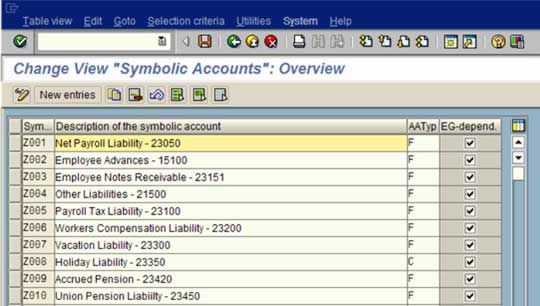

Step 2 - Defining Symbolic Accounts

Symbolic Accounts are names used in HR/Payroll instead of G/L account numbers:

- They’re similar to account keys in SD

- You can think of symbolic accounts as an intermediate step to determining the proper G/L account

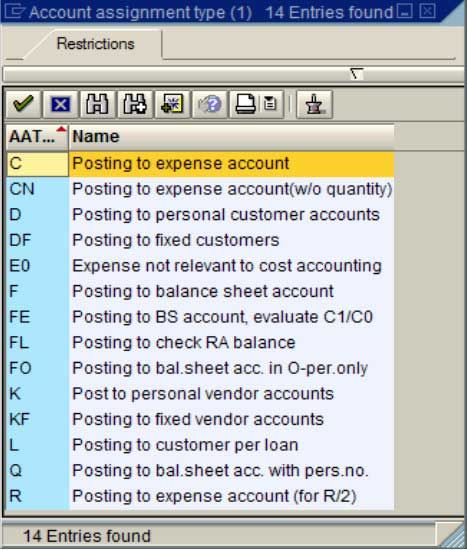

The types of symbolic accounts are:

- Financial – Balance Sheet

- Cost – Income Statement

- Vendor – Vendors

- Customer – Customers

Symbolic accounts have an employee grouping key, which allows the symbolic account to be associated with different G/L accounts:

- Employee groupings are done with the payroll schema during payroll processing

- Hourly employees may post to a different G/L account than salaried

How to Add/Maintain Symbolic Accounts:

- Use IMG Payroll>Payroll:USA>Posting to Financial Accounting>Activities in the HR System>Employee Grouping and Symbolic Accounts>Define Symbolic Accounts

- IMG Payroll>Payroll:USA>Posting to Financial Accounting>Activities in the HR System>Employee Grouping and Symbolic Accounts>Define Symbolic Accounts

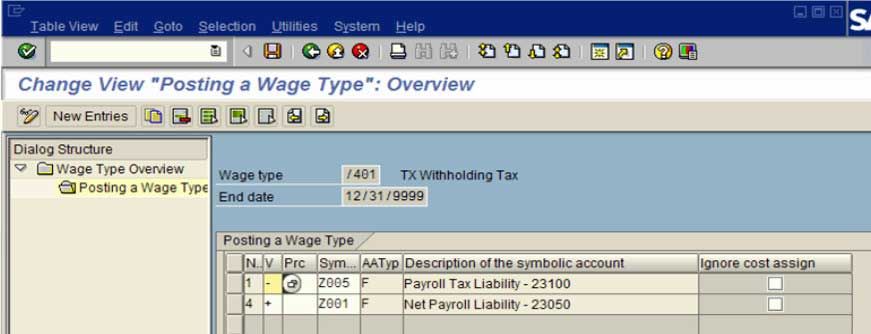

Step 3 - Mapping Wage Types

Next, Wage Types need to be mapped to symbolic accounts so R/3 can determine which G/L accounts to update:

- Use IMG path: Payroll>Payroll:USA>Posting to Financial Accounting>Activities in the HR System>Wage Type Maintenance>Define Wage Type Posting Attributes

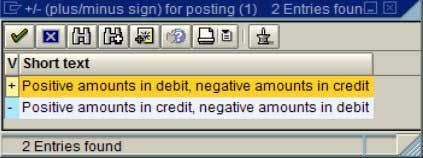

Note: There are no debits and credits in the bizzaro world of Payroll. Use a + like a debit and a – like a credit.

Important Tips:

- Know what each wage type is used for before maintaining them

- Know how each wage type relates to financial transactions: Make sure your payroll and FI/CO teams communicate.

- When in doubt create a new symbolic account: Sometimes the intended use of the wage type is not completely understood or may change over time. Often, when it comes time to change how the wage type is posting in the G/L, people will take a short cut and change the mapping of the symbolic account that is assigned to that wage type. If that symbolic account is assigned to other wage types that are posting correctly, you can break more than you are fixing.

- There are no debits and credits in the bizzaro world of Payroll. You have to choose between a “+” or a “-”

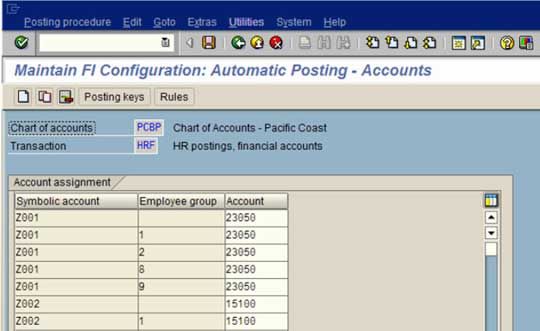

Step 4 - Mapping Symbolic Accounts to G/L Accts

Next, you need to map symbolic accounts to G/L accounts:

- Technically, the task resides in the FI module

- The mapping is an Automatic Account Assignment T030 – just like any other FI automatic account assignment

- Very Straightforward

- Use Transaction code OG00 (shown below)

Tips:

- Work closely with Payroll team to coordinate how the symbolic accounts are being used

- Be careful about changing the mapping. Make sure that the symbolic account you want to change isn’t assigned to another wage type that needs to post where the symbolic account is currently set to post!

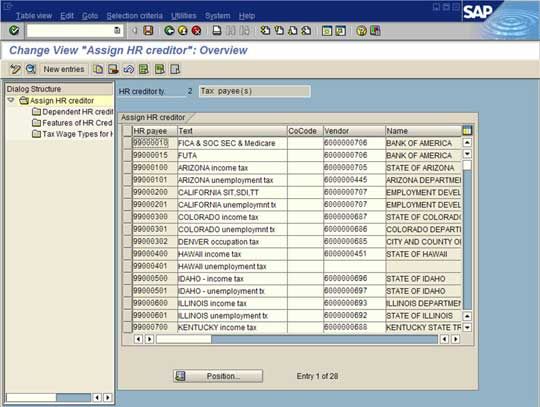

Step 5 - Mapping HR Payees to a Vendor Acct

I described a “third-party remittances” feature earlier. During payroll you can also accrue liabilities for and pay. Garnishment Processors and the other types of vendors are posted to AP during the third-party Remittance process.

- Benefit Providers

- Tax Authorities

- Garnishment Vendor Processors

- Other deduction vendors

Garnishment Processors are directly connected to an AP Vendor:

- When creating a garnishment document for an employee, the user selects an AP Vendor directly

- All other types of vendors go through the third-party mapping process

The key integration point is mapping/linking the HR payee to an A/P Vendor account.

Enhancing FI/CO Updates and Cash Management

Std. R/3 Lacks an Automatic Payroll-FICO Link

As was shown earlier there is no “automatic” integration link between Payroll and FI/CO: The integration between the two is manual and somewhat “forced”.

A vanilla implementation of Payroll with FI/CO (which SAP assumes and allows for in standard functionality) is as follows:

Step 1: Map net payroll results (outgoing cash) to your bank clearing account or another clearing account. This is done when you map symbolic accounts to G/L accounts.

Step 2: Manually journal from the clearing account to the bank clearing account. Done via a manual journal entry, either FB01 or FB50.

Going with this standard approach has disadvantages:

- It’s cumbersome:Especially for corporations that use one company code to make payments for other company codes.

- It’s error prone – manual processing always allows more room for error

- There is no financial link between the general ledger line items in the bank clearing account and the check register

SAP Has Released a Solution!

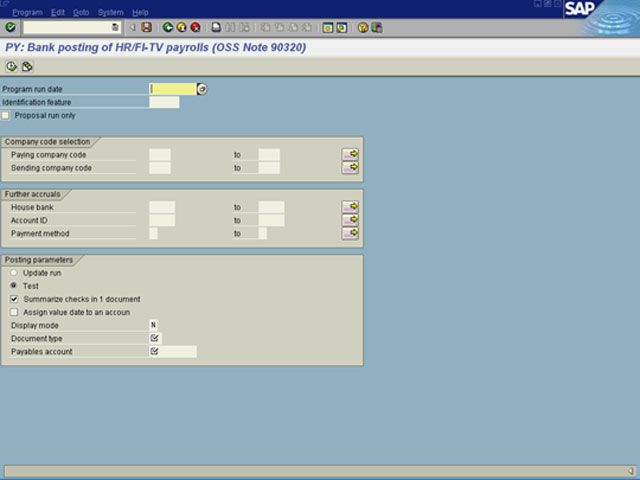

Using the enhanced functionality provided in OSS 90320 you can automate your clearing journal entries and link your G/L line items to the check register! OSS 90320 allows you to create program RFPYHR00 in your SAP system – available from Release 3.0a

Program RFPYHR00 requires the payroll result to be posted to a clearing account:

- Pick a single clearing account for each company code and map it to the proper symbolic accounts

- Automatically journals out of the clearing account and into the proper bank clearing account and company code-based off of the DME run in the payment program

- This program is a must-have in a cross-company code payroll scenario

Important Steps When Using RFPYHR00

It’s important to do things in the following order or your updates could get out of order or you could lose your linking of checks in the check register to line items in the G/L:

- Transfer payroll to FI/CO

- Create DME

- Print DME

- Run RFPYHR00

Note: If you run RFPYHR00 after creating the DME but before you print the DME your payroll checks in the check register won’t be linked to an Warning accounting document.

Key Points:

- In standard R/3 you must manually transfer payroll results to FI/CO. There is no automatic integration posting like in other parts of SAP

- You can automate payroll-to-FI/CO payment postings, however, by applying OSS 90320 this creates program RFPYHR00 in your system and RFPYHR00 is a must-have for cross-company code payroll payments

- The Payroll Payment Program doesn’t update FI/CO like it does in A/P, it only updates the check register

- Payroll-to-FI/CO integration is supported by configuration

- Wage types are mapped to symbolic accounts

- Symbolic Accounts are mapped to G/L Accounts

- Mapping Payroll Payees to A/P Vendors is the key integration step for third-party Remittances/Garnishments

- CATS can be used to spread labor costs over different cost centers

- Create new payment types in the A/P payment program for payroll payments

Read Here for More SAP HR Tutorials