In this SAP MM tutorial, we will learn the step-by-step procedure to maintain tax indicators for material in SAP with proper screenshots.

The tax classification indicator of material in SAP Material Master provides the taxability of the material for every purchasing transaction. This indicator and the ship-to/ship-from jurisdictions give the information necessary for calculating the sales or use tax.

How to Maintain the Tax Indicator for Material?

Please follow the steps below to maintain the tax indicator for material:

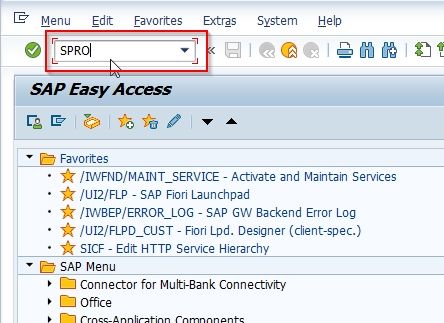

Execute t-code SPRO in the SAP command field as shown in the image below.

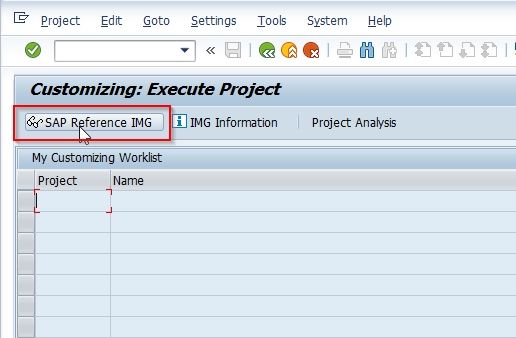

Next, click the SAP Reference IMG button to proceed.

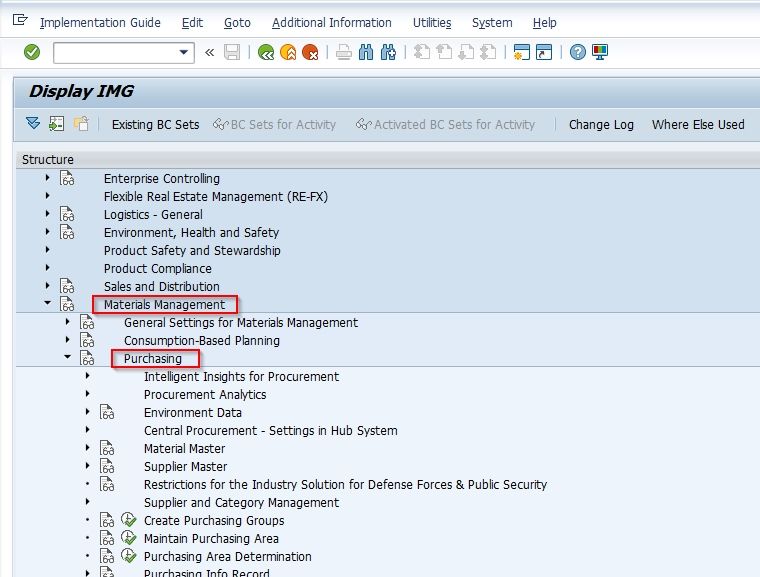

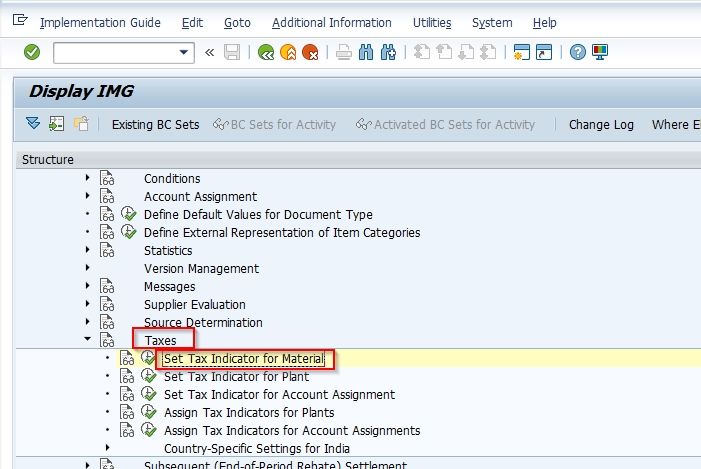

Now navigate to the following SAP IMG path:

SPRO > Reference IMG > Materials Management > Purchasing > Taxes > Set Tax Indicator for Material

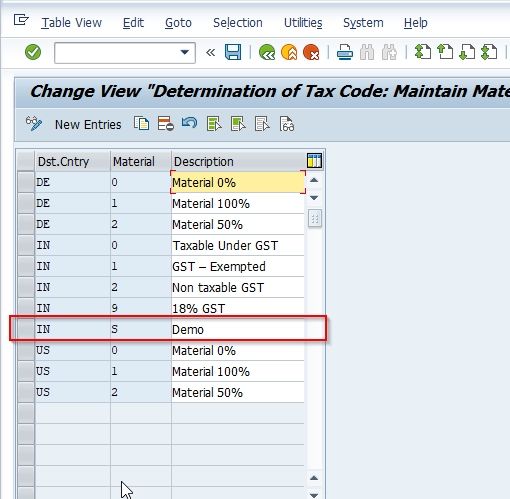

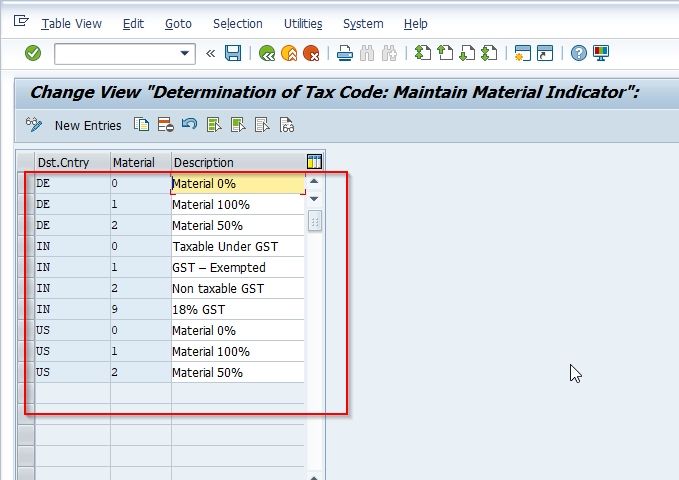

Next on the Change View "Determination of Tax Code: Maintain Material Indicator": Overview screen you will see the list of previously created tax indicators.

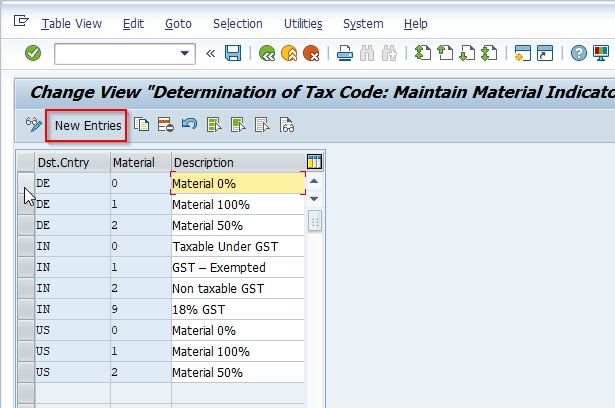

Click the New Entries button to maintain a new tax indicator in your SAP system.

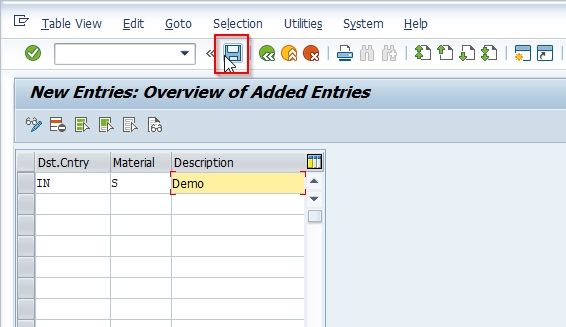

Now input the following details of the new tax indicator according to your requirement as shown in the image below:

.jpg)

Once all details are entered click the Save icon to save the newly created tax indicator for material in your SAP system.

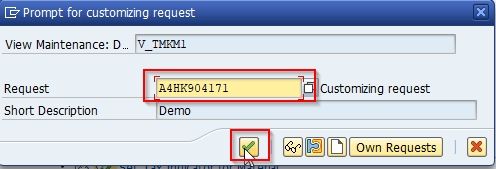

Next, select your Customization Request id and press Enter key to proceed.

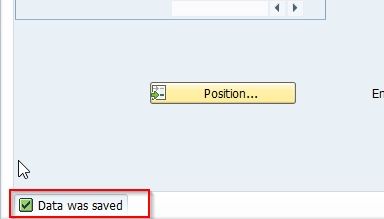

The status bar displays a message Data was saved on the bottom of your screen.

You have successfully created a new Tax Indicator in your SAP system.