Reverse Charge Tax Configuration Scenario For GST India

Configuration for Procurement

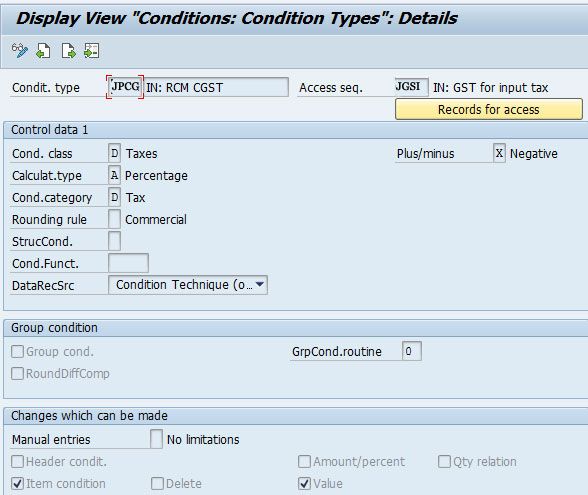

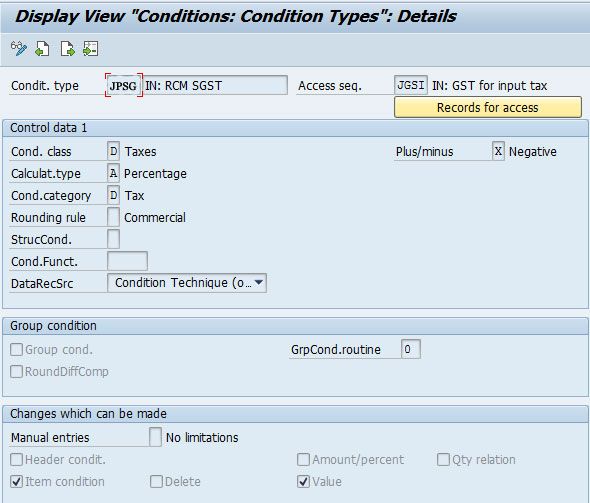

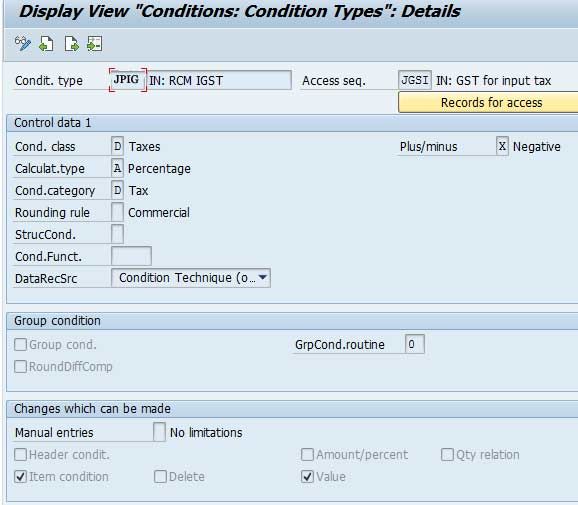

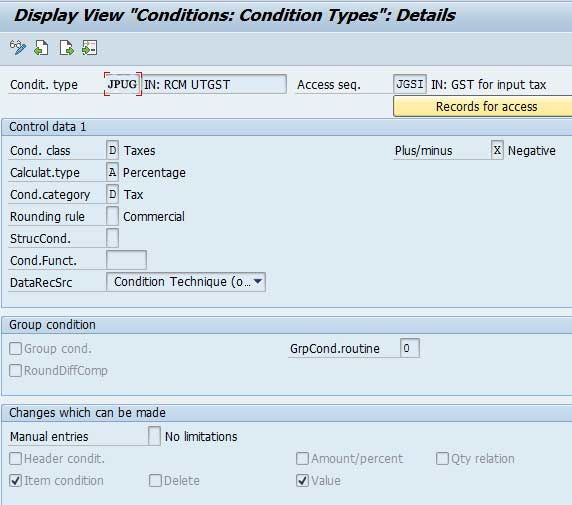

Condition types

1.Deductible reverse charge condition types

Below are the 4 reference condition types delivered in previous tutorial to handle GST for taking credit (CGST, SGST, IGST, and UTGST). such as

- JPCG

- JPSG

- JPIG

- JPUG

NOTE: The condition types provided are for reference only. You can copy and change as per your needs.

Now we have to create 4 negative condition types for reverse charge as shown below (with screenshots)

Please execute the t-code OBQ1 or please use IMG path given below:

SPRO -> Financial Accounting (New) -> Financial Accounting Global Settings (New)-> Tax on Sales/Purchases-> Basic Settings-> Check Calculation Procedure-> Create Condition Types.

Condition Types for Deductible Reverse Charge

| Condition Types | Description |

| JPCG | IN: RCM CGST |

| JPSG | IN: RCM SGST |

| JPIG | IN: RCM IGST |

| JPUG | IN: RCM UTGST |

JPCR – IN: RCM CGST - Reverse Charge Condition type for Central GST

JPSR - IN: RCM SGST - Reverse Charge Condition type for State GST

JPIR – IN:RCM IGST - Reverse Charge Condition type for Integrated GST

JIUR – IN: RCM UTGST - Reverse Charge Condition type for Union Territory GST

Note: The user can use the access sequence JGSI or MWST as per your business requirement.

2.Non-Deductible reverse charge Scenario

Below are the 4 reference condition types delivered in the previous tutorial to handle GST for non-deductible cases (CGST, SGST, IGST, UTGST, and CESS). such as,

- JPSN

- JPCN

- JPIN

- JPUN

Now we have to create 4 negative condition types for Non-Deductible condition types by referring deductible RCM condition type. Such as, JPCR user can copy this and create your own condition type.

The table below are the non-deductible reverse charge condition types

| Condition Types | Description |

| PCRN | IN: RCM CGST Inv |

| PSRN | IN: RCM SGST Inv |

| PIRN | IN: RCM IGST Inv |

| PURN | IN: RCM UTGST Inv |

Note: These P conditions are just a reference condition types for non-deductible scenario.

Accounting Keys

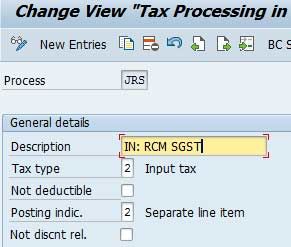

In order to create accounting keys please execute the t-code OBCN

Deductible Condition Types Accounting keys

| Account Key | Corresponding deductible condition type |

| JRS – IN: RCM SGST | JPSG- IN: RCM SGST |

| JRC - IN: RCM CGST | JPCG - IN: RCM CGST |

| JRI - IN: RCM IGST | JPIG - IN: RCM IGST |

| JRU - IN: RCM UTGST | JPUG - IN: RCM UTGST |

Reference Accounting key maintenance for JRC is given in screenshot below:

User must create Accounting key maintenance for other duties in the same way.

Note: Create your own accounting key and assign separate G/L account for non-deductible condition types.

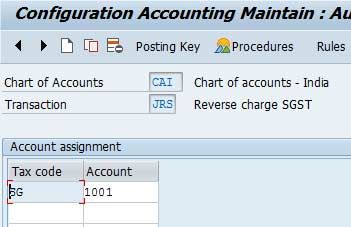

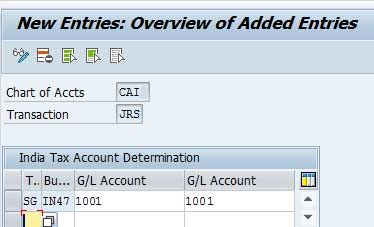

G/L Account Assignment

In order to assign G/L accounts please execute t-code OB40

Now as per as law change for reverse charge in GST India regime, the person who gets the service has to pay full GST tax i.e. 100% to the Government.

It is recommended to directly post the tax amount to the final payable account and do the payment to the Government according to the pending payables for each period on the payment date.

Also, create a separate G/L account for reverse charge deductible condition types(duties) and assign the same to accounting key. Below are the screen shots examples:

Now in view J_1IT030K_V please maintain the G/L account

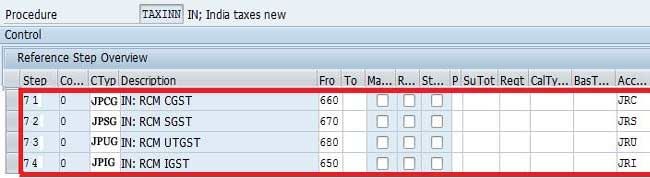

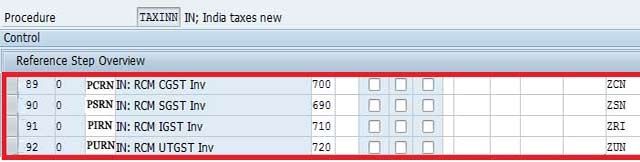

Update Tax Procedure - TAXINN

First execute the transaction OBQ3

Now please maintain the defined condition types and account keys in the tax procedure as given below,

1.Deductible scenario:

2.Non-deductible scenario (Expense out)

Condition records maintenance for reverse charge condition types

Condition records for reverse charge condition types must be created using transaction FV11/FTXP (For Tax classification category) according to your business requirement.

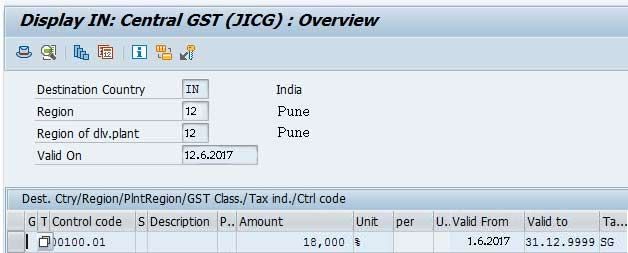

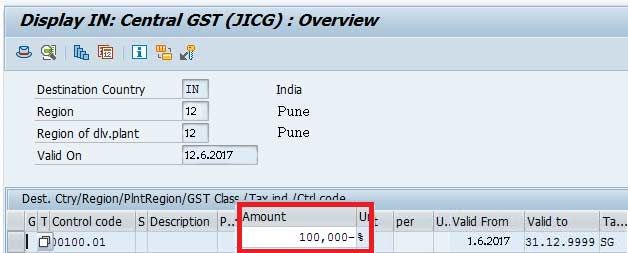

For example, let’s consider the GST taxes rates (CGST, SGST, IGST & UTGST) are maintained as 18%, Therefore now we need to create condition records for the reverse charge condition types maintaining it as 100% in order to fulfill the percentage of reverse charge (Applicable for both deductible and non-deductible scenario).

This table is deductible CGST condition types which is maintained 18%

Now below is reverse charge deductible CGST condition types maintained 100% (As in GST it is 100% reverse charge)

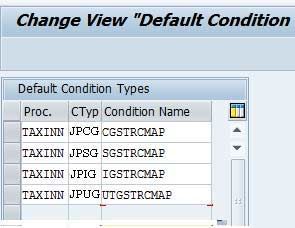

Condition Types Classification

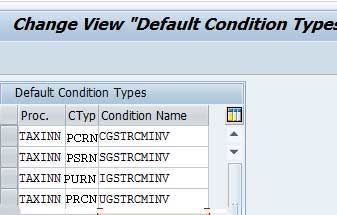

Using t-code SM30 please classify the reverse charge condition types in the J_1IEXCDEFN view

Deductible Condition Types

Non - Deductible condition types

Examples for Reverse Charge Posting

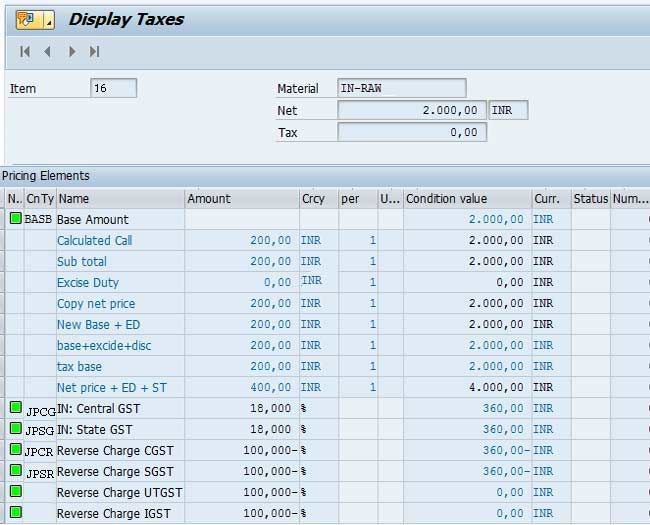

Case 1: - Reverse Charge with 100% Tax credit

Create a PO with GST duties for intrastate procurement with rate as example CGST & SGST 18%.

Accounting Simulate in MIRO transaction (Invoice verification):

Case 2: - Reverse Charge without tax credit (100% Expense out)

In case, of reverse charge without credit scenarios, the whole amount is expensed out. Create a PO with GST duties for interstate procurement with rate. For example, IGST 18%.

Accounting Simulate in MIRO transaction (Invoice verification):