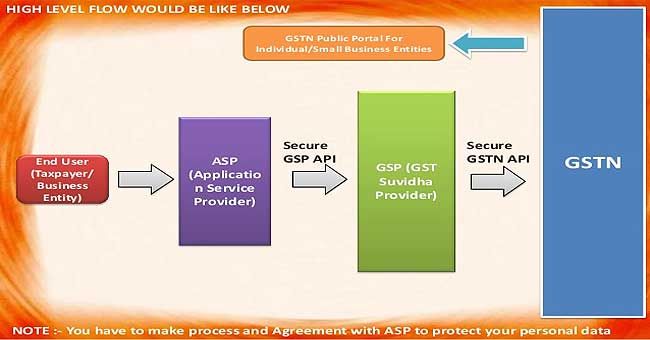

The GST India administration will have two major players:

- GST Suvidha Provider (GSP)

- Application Service Provider (ASP)

Read more here Indian Tax Procedure Migration from TAXINJ to TAXINN

The following diagram shared by GST Network (GSTN) offers this clarity

Every GST registered entities must submit their Supply Invoices to GSTN via this digital medium.Therefore, registered Vendors should also upload their Supply Invoices, which will be the basis for determining Input Tax Credit (ITC). After accepting the invoices from vendors, formal ITC will be available.

Note: The above rule can change be changed once the final IGST Act, CGST Act and SGST Act are published and made available.

On the basis of data provided to GSTN, it is expected, that returns will be auto populated and must be verified and accepted by GST registered entities.

Every interaction with GSTN will be via published APIs (Application Process Interface). The ecosystem of GSPs is expected to provide a secure transfer of data to GSTN and back, recording logs of transactions, and provide necessary audit trails and reports to GSTN as desired.

These uploads and downloads will be facilitated by consuming APIs of GSTN through a dedicated MPLS line or a VPN line.

Further, there will be a charge for data upload of invoices and the returns. These details are work in progress.

Difference between GSP and ASP

GSP (GST Suvidha Provider) is an organisation which will act as a channel of data transfer from the Taxpayer and ASP to GST system at GSTN. The GSP will have an agreement with GSTN, therefore will provide a secured access to GST System A

Whereas ASP (Application Service Provider) will provide a GST based data in a specified format using the GST APIs exposed through GSP. A taxpayer can have multiple ASPs with a condition that the cluster of data across all the ASPs should be managed by the taxpayer.

Read more here Difference between TAXINJ and TAXINN in SAP

Division of Taxpayer

With respect to the GST ecosystem, taxpayers can be divided into following three categories:

- Taxpayers with standalone or networked systems that are not connected with the Internet

- Taxpayer with applications with API interfaces such as SAP, Oracle, Microsoft ERP etc.

- Taxpayer with applications that are in the cloud and can work in both offline and online mode, well-defined API based architecture, and use latest technologies.

How SAP Offering ASP

SAP will be offering ASP not GSP. GSTN will enable API based consumption for data transmission and communication with the help of GSPs Application Service Providers (ASPs) in order to offer related value added services.

SAP will be an ASP and will make provisions to address the following:

| Form / Report | Details |

| GSTR-1 | Outward Supplies Details |

| GSTR-2 | Inward Supplies Details |

| GSTR-3 | Monthly Return |

| GSTR-6 | ISD Return |

| GSTR-7 | TDS Return |

| GSTR-8 | Annual Return |

| GSTR-9 | Reconciliation Statement |

| GSTR-10 | Final Return |

| Utility Tool | Vendor Invoice credit reconciliation |

| Utility Tool | Utilization Dashboard |

Read more here SAP GST FAQ

- The expectation is to deal with a large volume of data and we expect supply invoices themselves to be ranging from 45,000 to above 6,00,000 invoices on a monthly basis.

- As a result the development will be offered on HANA Cloud Platform (HCP) and on S/4 HANA.

- Discussions with prospective GSPs are underway so that technical integration of SAP ASP solution with GSP is technically feasible.

Note: The agreement to run daily transactions are: procure to pay, order to cash, stock transfers and such will be handled as part of the regular legal change/agreement offering.