What is Retained Earnings Account?

Retained Earnings Account is a type of account that is used to carry forward the balance of one financial year to the next fiscal year. It is defined in SAP Fi using t-code OB53.

Retained Earnings Account is used to maintain the G/L number in which the system will transfer the P/L amount at the end of the fiscal year when the user runs the balance carry forward activity.

It can be assigned to every P/L account in the Chart of Account (CoA) to automatically carry forward the balance to the next fiscal year.

Define Retained Earnings Account

Please follow type step by step process shown below to define retained earnings account:

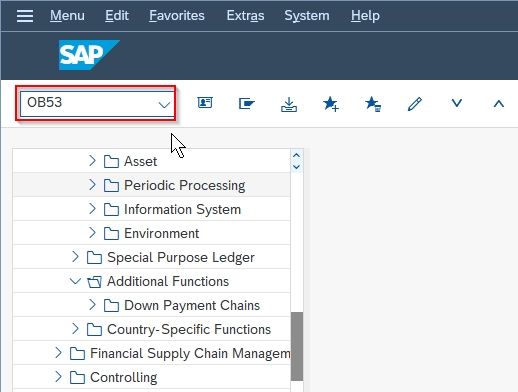

Step-1: Execute t-code OB53 in the SAP command field

(OR)

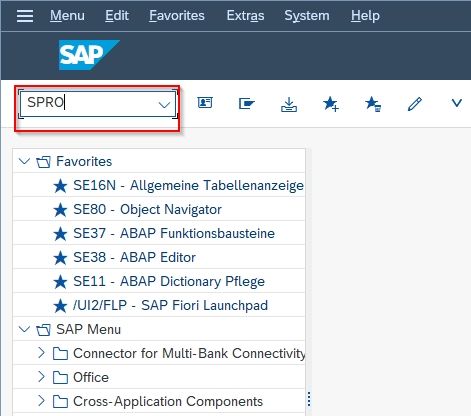

Execute t-code SPRO in the SAP command field

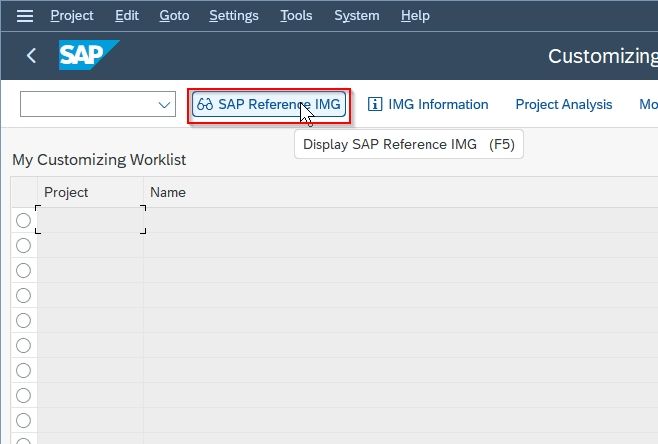

Next click on the SAP Reference IMG.

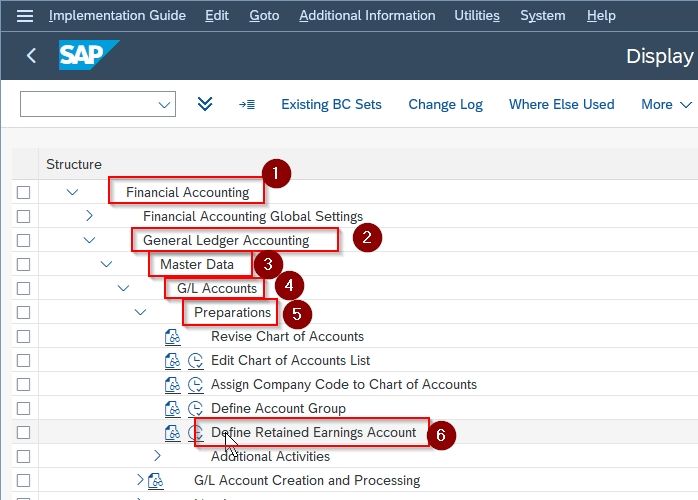

Now go to the following SAP menu path:

Financial Accounting → General Ledger Accounting → G/L Accounts → Master Data → Preparations → Define Retained Earnings Account.

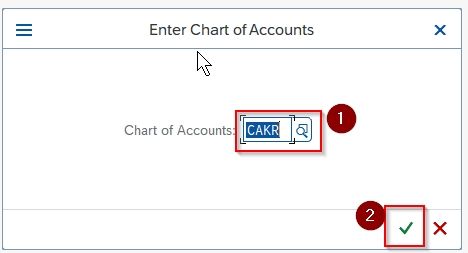

Step-2: Now enter the CoA to maintain the Retained Earnings Account and then press Enter to proceed further.

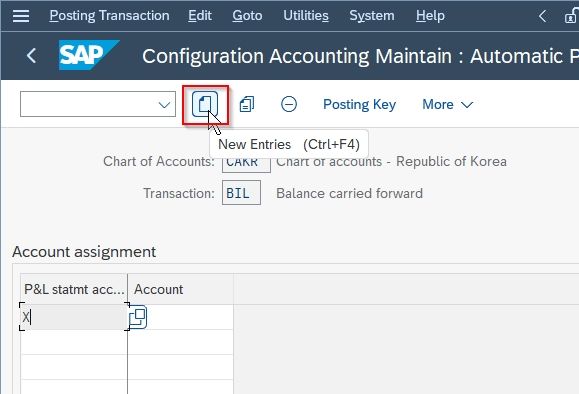

Step-3: Next click the New Entries button to create a new retained earning account.

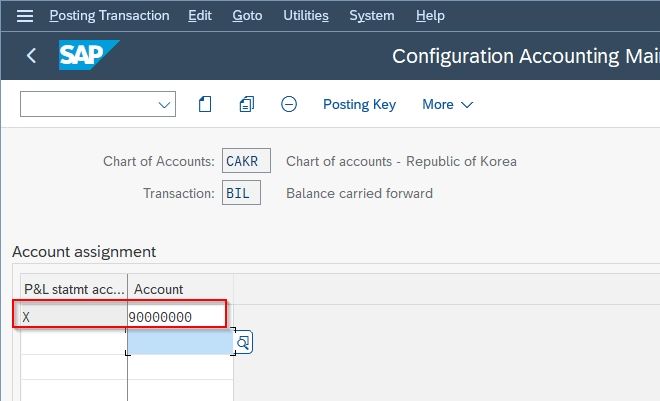

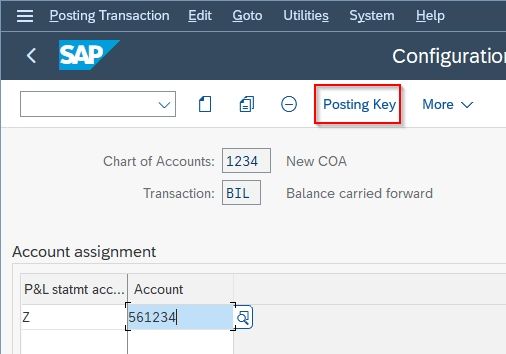

Step-4: Enter the following details:

- Enter P&L statement account type

- Enter G/L Account to be considered Retained Earnings account

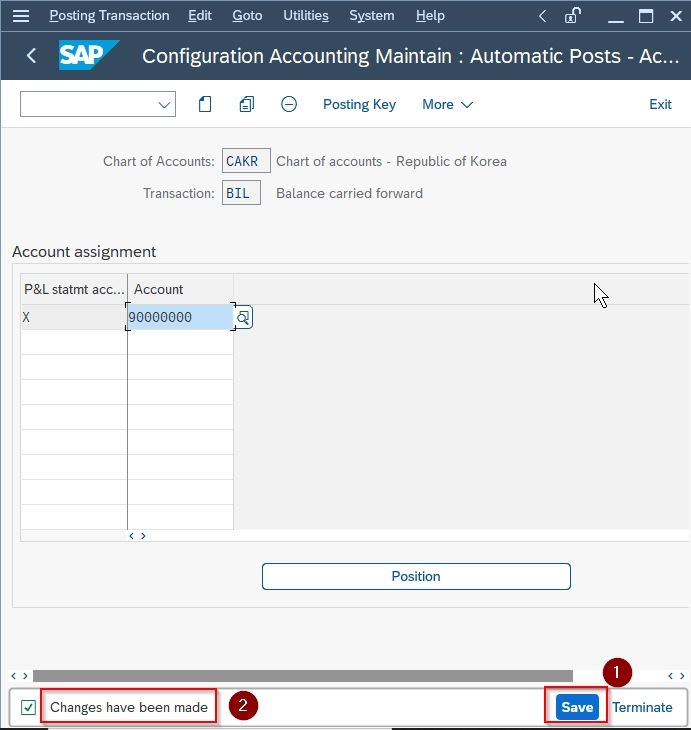

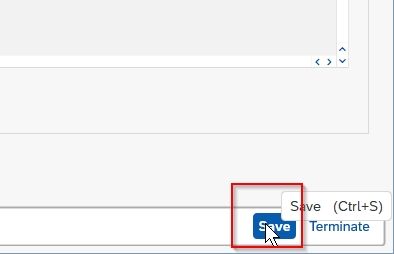

Step-5: Once all the required details are filled click the Save button

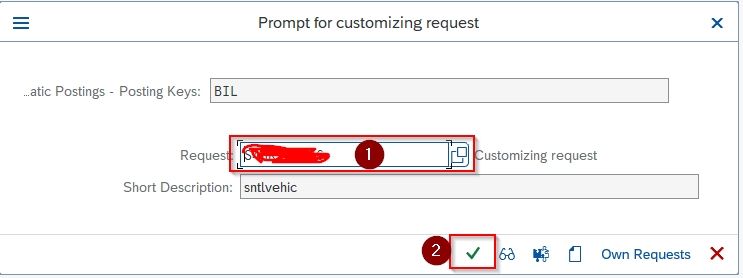

Step-6: Next select your Customizing Request and press Enter to proceed

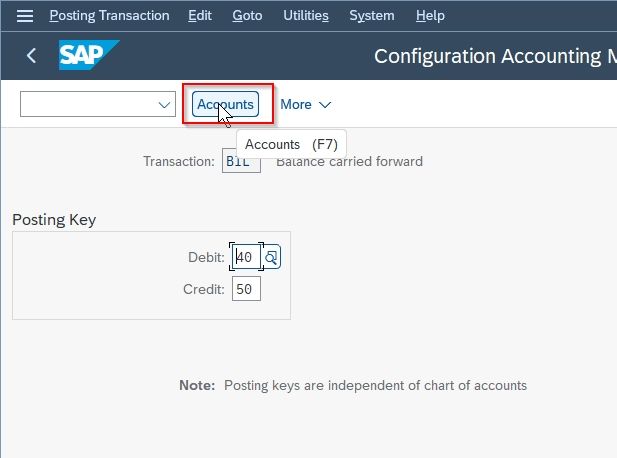

Step-7: Now click the Postings Key to maintain the posting key for this account.

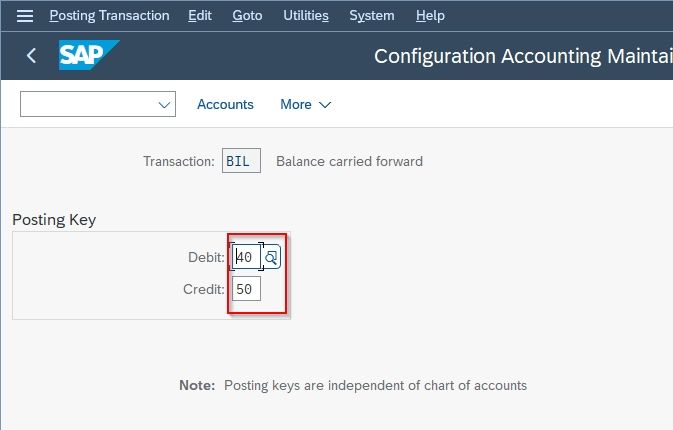

Step-8: Then assign posting key for Debit and Credit.

Step-9: Next click the Accounts button to go back to the accounts screen.

Step-10: Again click the Save button to save the Retained Earnings Account account.