What is Document Splitting?

Document splitting in SAP ERP is a powerful tool used for financial reporting and segment reporting by splitting the line items based on predefined characteristics. It helps to ensure accuracy in financial statements and to meet compliance requirements.

Document splitting provides a flexible and efficient way to manage financial records and allocate expenses in SAP ERP.

Elements of Document Splitting

The elements of document splitting in SAP ERP are:

- Characteristics: The defining characteristics of the line items that are used to split the document.

- Split Valuation: The process of creating separate line items based on the defined characteristics.

- Valuation Area: The specific area where the document split is performed and results are recorded.

- Assessment: The calculation of the distribution of costs or revenues to the different valuation areas.

- Realignment: The process of adjusting or realigning the split line items if necessary.

- Transfer of Split Data: The process of transferring the split data to other systems or areas of SAP for further processing or analysis.

Note: These elements work together to provide a comprehensive solution for financial reporting and segment reporting in SAP ERP.

Example of Document Splitting

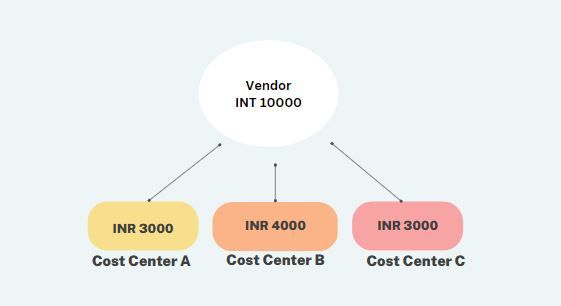

Suppose a company has received an invoice from a vendor for INR 10,000. The vendor invoice is posted in SAP ERP and assigned to a specific profit center. Now, the company wants to split the vendor invoice into multiple parts and allocate it to different cost centers.

To do this, the company uses document splitting. Document splitting is a process where the vendor invoice is divided into multiple parts and allocated to different cost centers based on predefined rules or custom splitting rules.

In this case, the company has set a rule to allocate INR 3,000 to cost center A, INR 4,000 to cost center B, and INR 3,000 to cost center C.

The system splits the vendor invoice into three parts and assigns each part to the respective cost centers. This helps the company to track and manage expenses for each cost center separately and make informed decisions based on the data.

Types of Document Splitting

There are three types of document splitting in SAP ERP:

Passive Splitting

Passive splitting in SAP ERP refers to the automatic division of a payment document based on the way a vendor invoice has already been split.

This process helps ensure accuracy and consistency in the financial records, as the payment document is split in the same manner as the vendor invoice.

Active Splitting

Active splitting in SAP ERP is the process of dividing a document into multiple parts based on predefined rules within the mySAP ERP system. These rules are designed to support various business transactions and can be adjusted to meet specific requirements.

This process provides greater control and flexibility in financial management and record-keeping within SAP ERP.

Zero Balancing

Zero Balancing Splitting in SAP ERP refers to the automatic generation of a new line item to balance a financial document when the amounts within the document do not balance between the debit and credit of a profit center.

The system automatically generates a balancing line item to ensure that the financial documents maintain a balanced structure, ensuring that the books are kept in accordance with accounting principles.

This helps minimize the risk of errors and ensures that the financial records are accurate and up-to-date. Zero Balancing Splitting is a feature of SAP ERP that helps ensure the accuracy and consistency of financial records.

Zero Balancing Example

As mentioned above, when the system is unable to balance out the transaction entry on its own, it compensates by using a "zero balancing" account. The system adds this account automatically to bring the transaction to a zero balance. Let's see an example of this now.

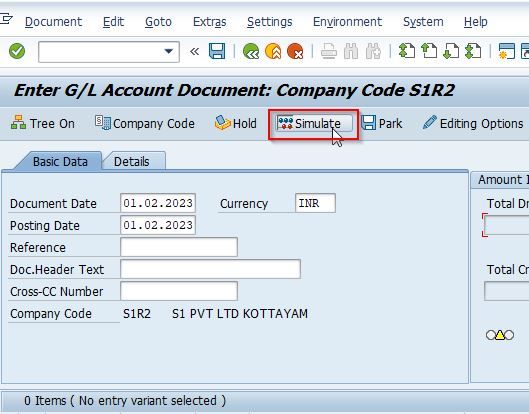

Execute t-code FB50 in the SAP command field

.jpg)

Now select the company code for which you want to perform the zero balancing

.jpg)

Next enter the transaction entry according to the required criteria of zero balancing

.jpg)

Now click on the Stimulate button to simulate this with General Ledger View

Configuration of Document Splitting

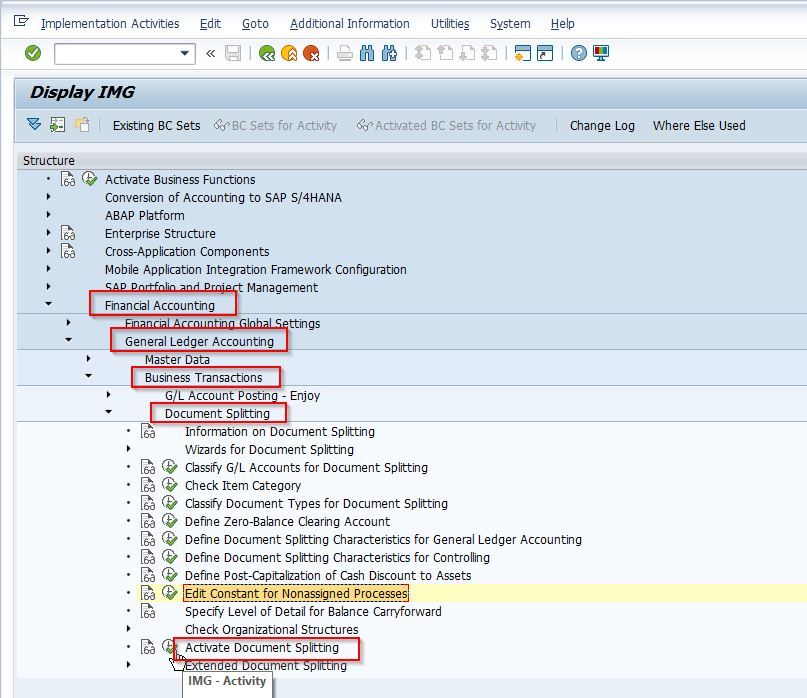

Please follow the steps below to configure the document splitting:

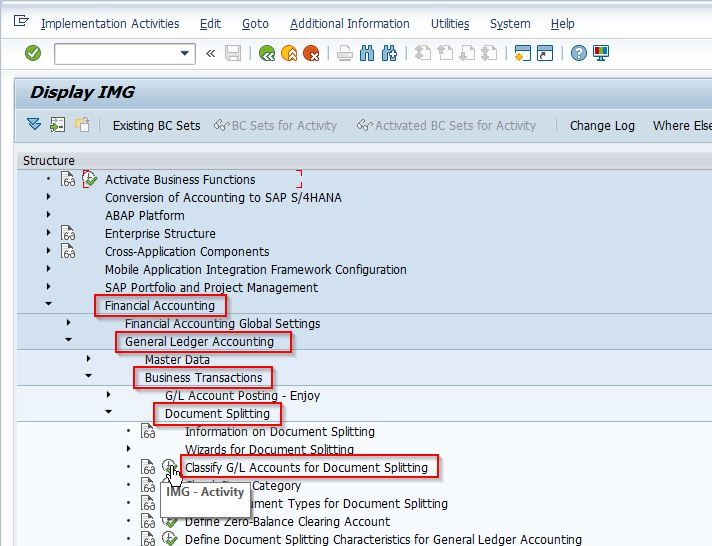

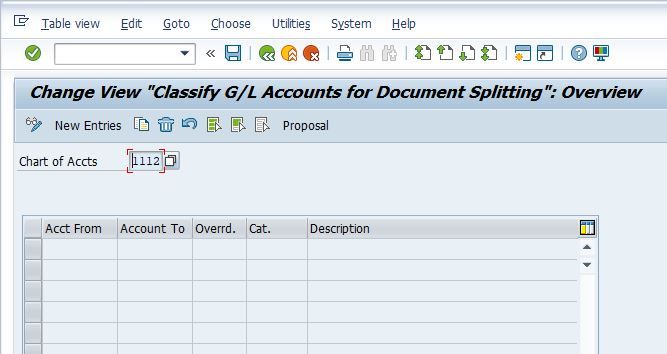

1) Classify GL Accounts for Document Splitting

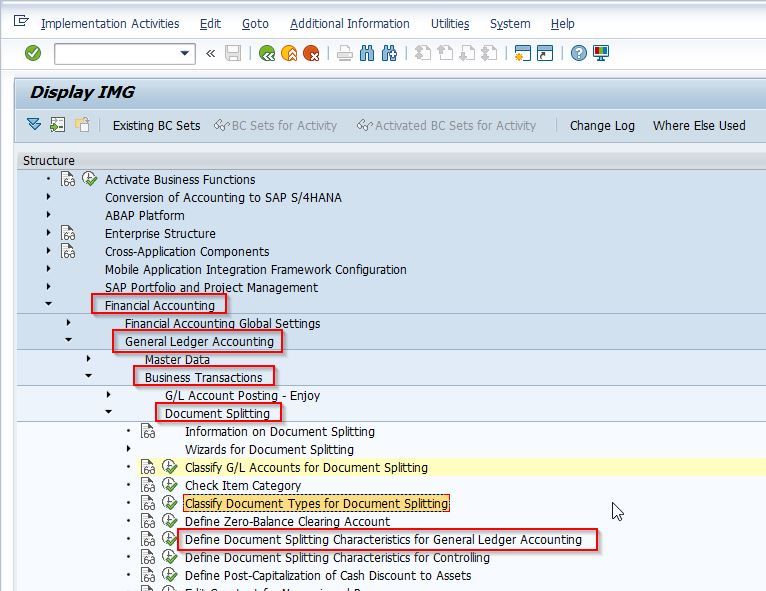

Please follow the SAP IMG path mentioned below:

SPRO –> SAP Reference IMG –> Financial Accounting –> General Ledger Accounting –> Business Transaction –> Document Splitting –> Classify G/L Accounts for Document Splitting

Next, select the Chart of Account and press Enter

.jpg)

In this step, General Ledgers (GLs) are classified based on item categories, taking into consideration the nature of the business transaction. It is advised to categorize the "Range of General Ledger Accounts" rather than assigning individual item categories to each General Ledger account.

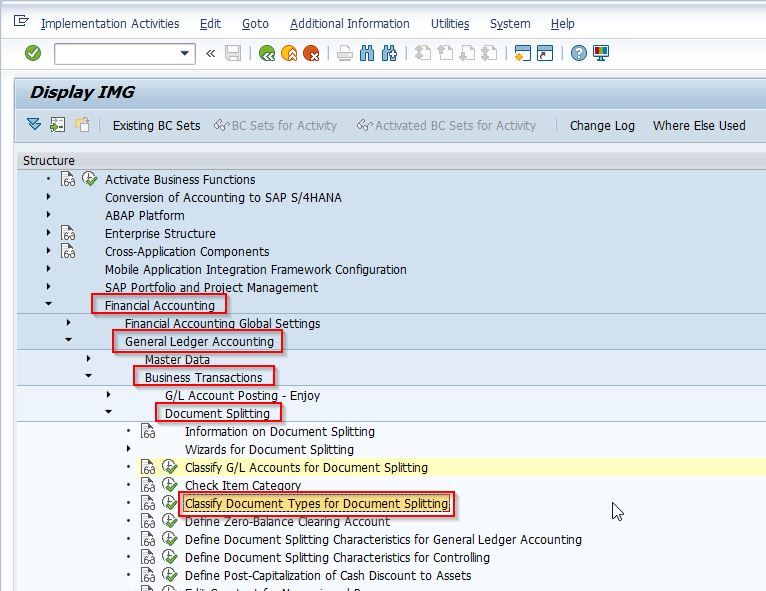

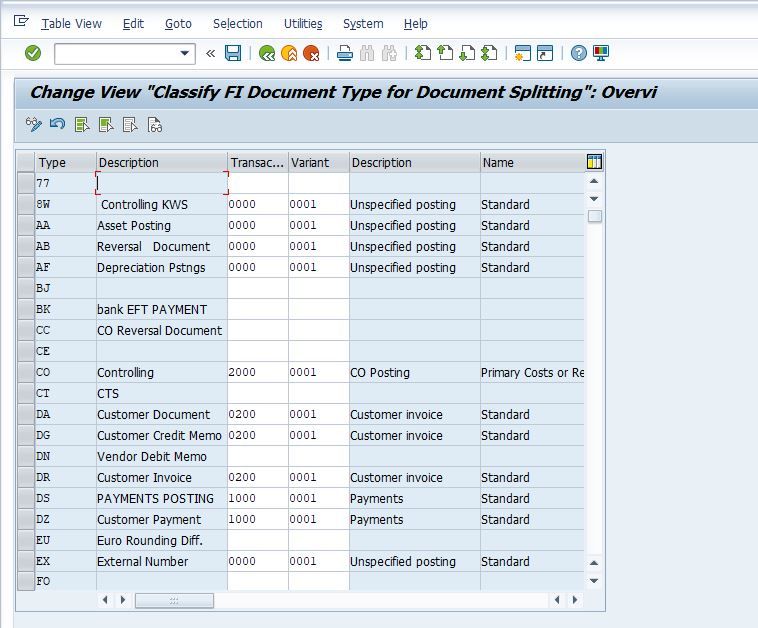

2. Classify Document Types for Document Splitting

Please follow the SAP IMG path mentioned below:

SPRO –> SAP Reference IMG –> Financial Accounting (New) –> General Ledger Accounting (New) –> Business Transaction –> Document Splitting –> Classify Document Type for Document Splitting

In this step, the "Business Transaction" and "Business Transaction Variant" are assigned to document types. As a result, nearly all financial transactions are eligible for document splitting.

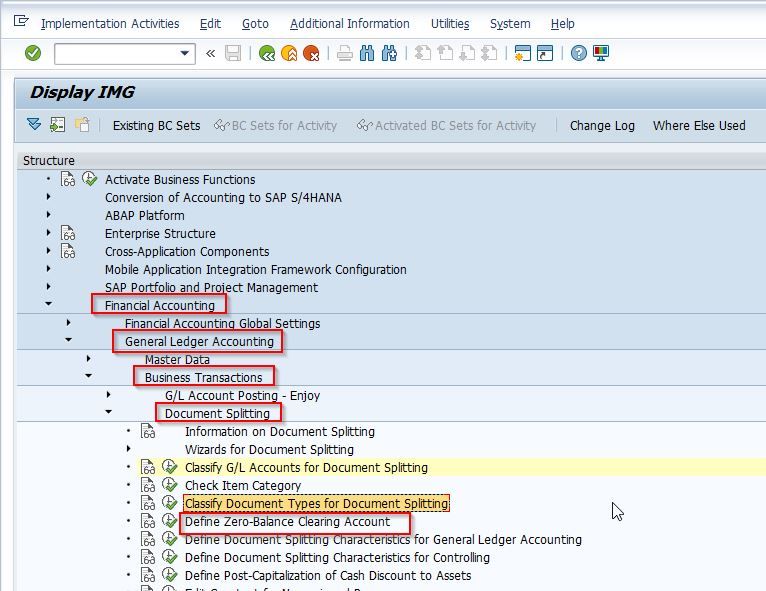

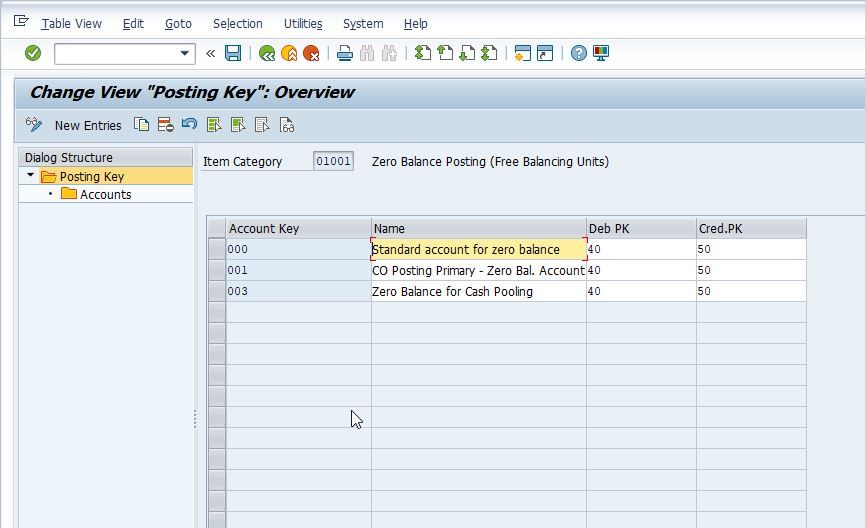

3. Define Zero Balance Clearing Account

Please follow the SAP IMG path mentioned below:

SPRO –> SAP Reference IMG –> Financial Accounting (New) –> General Ledger Accounting (New) –> Business Transaction –> Document Splitting –> Define Zero Balance Clearing Account

In this step, the definition of a zero-balance clearing account is established. This account will be utilized to generate and balance out financial entries when the system is unable to balance them on its own.

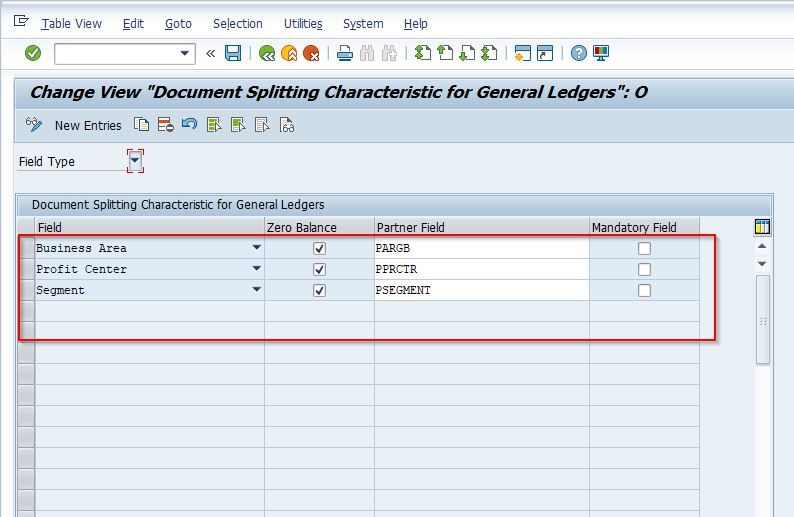

4. Define Document Splitting Characteristics for General Ledger Accounting

Please follow the SAP IMG path mentioned below:

SPRO –> SAP Reference IMG –> Financial Accounting (New) –> General Ledger Accounting (New) –> Business Transaction –> Document Splitting –>Define Document Splitting Characteristics for General Ledger Accounting

This is a crucial configuration step in document splitting. In this step, the splitting characteristics are defined, along with the determination of whether they should be zero balance or mandatory.

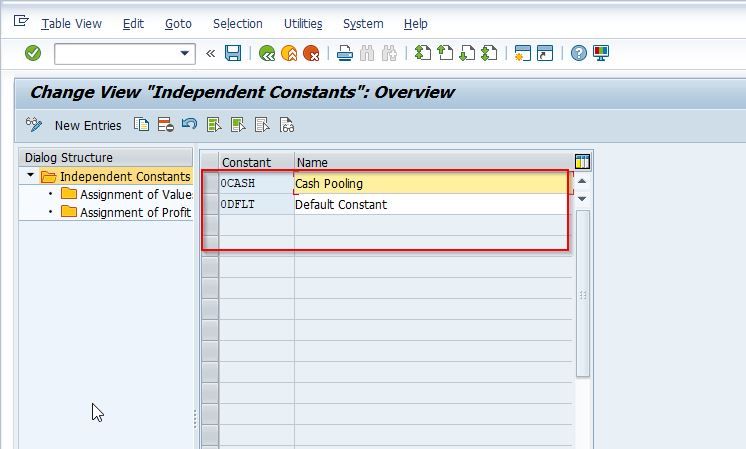

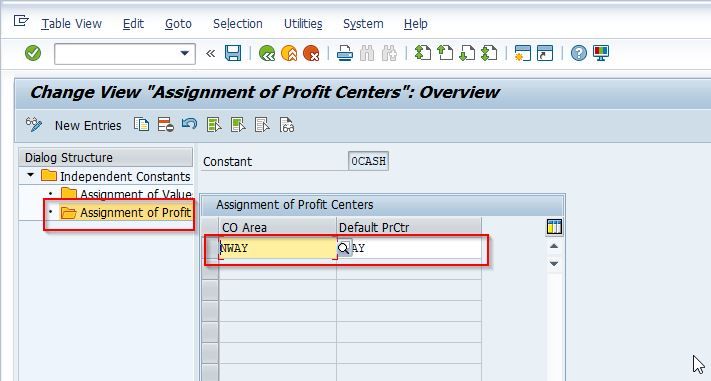

5. Edit Constants for Non-Assigned Processes

SPRO –> SAP Reference IMG –> Financial Accounting (New) –> General Ledger Accounting (New) –> Business Transaction –> Document Splitting –>Edit Constants for Non Assigned Processes

.jpg)

In this step, constants are defined to provide default account assignments when they cannot be obtained from other sources.

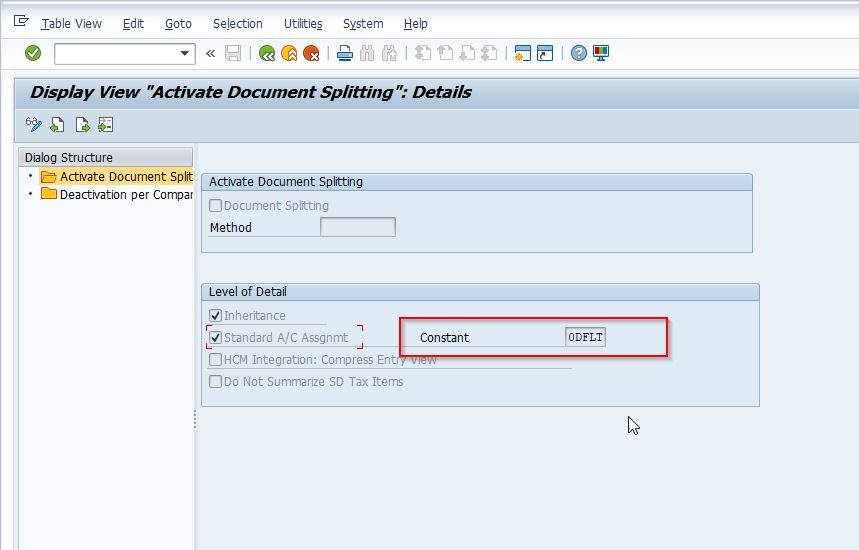

6. Activate Document Splitting

SPRO –> SAP Reference IMG –> Financial Accounting (New) –> General Ledger Accounting (New) –> Business Transaction –> Document Splitting –>Activate Document Splitting

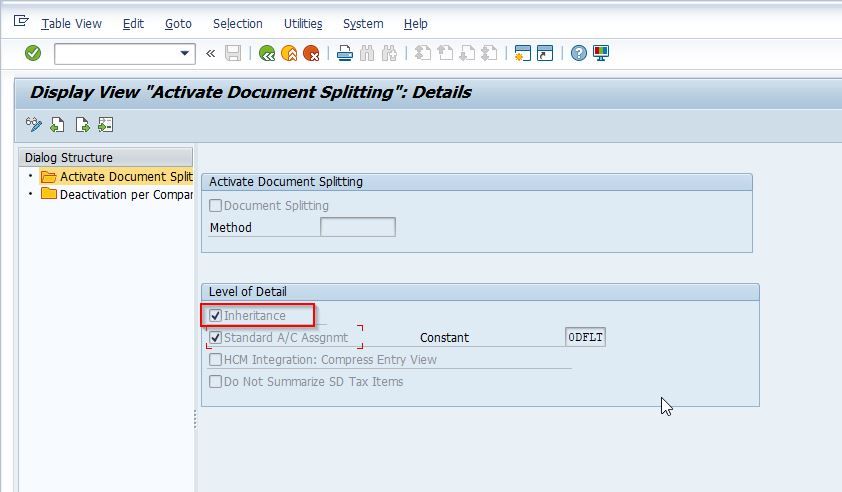

As a last step, we need to activate document splitting with various additional settings such as “Inheritance” and Activation of Document Splitting.

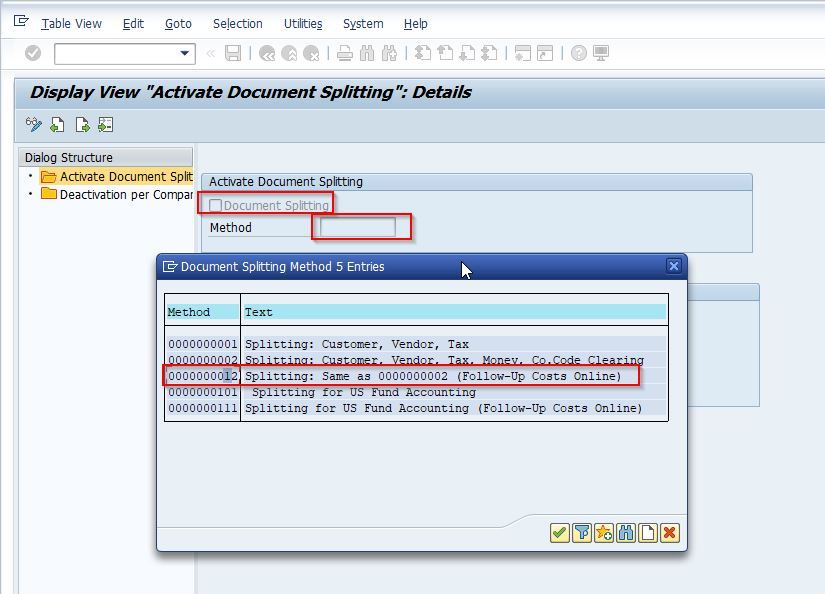

First, select the “Document Splitting” checkbox and apply the appropriate method according to your requirement. SAP Standard default method is “0000000012”.

Next, select the Inheritance option that defines line items without an account assignment and will obtain their assignment from another line item.

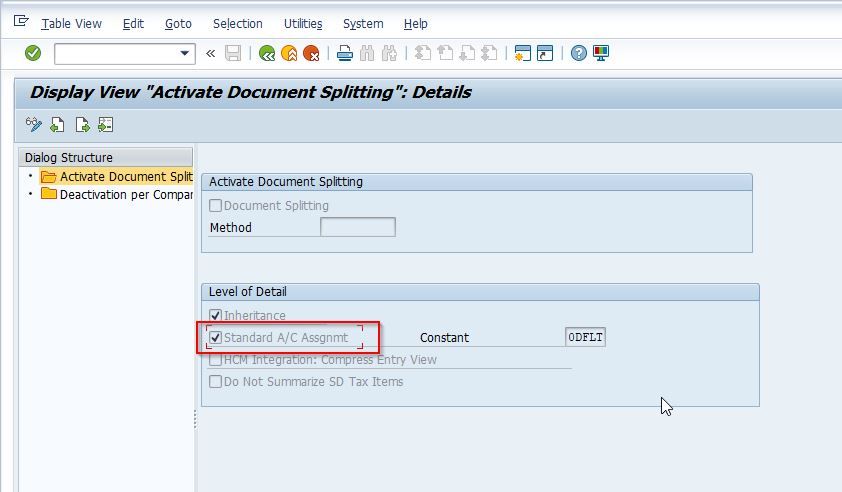

Now select the Standard Account Assignment option which means the system will set a standard account assignment for line items without one.

When this indicator is selected, a "Constant" must be maintained.

Note: The activation of Document Splitting occurs at the client level, but it can be controlled and turned on or off at the company code level.