Maintain Terms of Payment ( T Code – OBB8)

In the step Maintain terms of payment, you can define rules with which the system can determine the required terms of payment automatically. The rules are stored under a four-character key. You assign the terms of payment specified to the vendors in the master record via the key. The key and the terms determined with it are proposed when entering a document to the vendor account.

Note

You can specify a key in the master data area for Financial Accounting and Sales + Distribution. You should use the same key.

You can use the same key for the terms of payment for both customers and vendors who have the same payment terms. SAP recommends, however, that you use different terms of payment keys for customers and vendors and limit the permitted account type correspondingly within the terms of payment. This, for example, then has an advantage if the sales department of your company changes a payment term for a customer. You can then adapt the accompanying customer terms of payment key without vendors being affected by the same terms of payment.

There are two types of payment conditions,

1. The day limit: With this type of payment condition a cut off date is fixed (Day Limit) for determination of due date from base line date that date. In the following case. Posting date is the base line date, day limit is 15th the month & Fixed date is 30th of the month.

Example: if an invoice is posted on 12.10.2004, which is within 15th day of the month is due for payment on 30th of that month

2. The payment period baseline date :

Payment Term Key : It is used in sales orders, purchase orders, and invoices. Terms of payment provide information for:

• Cash management

• Dunning procedures

• Payment transactions

Data can be entered in the field for the terms of payment key in various ways as you enter a business transaction:

• In most business transactions, the system defaults the key specified in the master record of the customer/vendor in question.

• In some transactions (for example, credit memos), however, the system does not default the key from the master record. Despite this, you can use the key from the customer/vendor master record by entering "*" in the field.

• Regardless of whether or not a key is defaulted from the master record, you can manually enter a key during document entry at:

- item level in sales orders

- header level in purchase orders and invoices

Master records have separate areas for Financial Accounting, Sales, and Purchasing. You can specify different terms of payment keys in each of these areas. When you then enter a business transaction, the application in question will use the key specified in its area of the master record.

.jpg)

The configuration details of the payment terms 0003 is as follows :

This is applicable to both customer and vendor

We have configured as day limit as 15, fixed days 30 days and default base line date as posting date. This means if an invoice posted on or within 15th of a month is due for payment on 30th of the same month and if posted after 15th of a month 15th of the next month.

We have configured payment terms as if payment made with 14 days from the base line date 2% cash discount will be allowed, if payment made within 30 days of the base line date 1.5% cash will be allowed

Fields |

Description | |

| Payment Terms | Terms of payment key - Key for defining payment terms composed of cash discount percentages and payment periods. | |

| Day Limit | Day Limit - Day of the month up until which the corresponding terms are valid. | |

| Sales Tax | Description of terms of payment | |

| Own Explanation | Own Explanation of Term of Payment - Explanation of the terms of payment, which is different to the automatically created explanations. | |

| Account type Control | ||

| In this section we will select, whether this particular payment term applicable for customer or vendor | ||

| Base Line date Calculation | ||

| Fixed Day | Calendar Day for the Baseline Date for Payment - Calendar day with which the system overwrites the day of the baseline | |

| Date for payment of the line item. | ||

| Additional Month | Additional Months - Number of months, which the system adds to the calendar month of the baseline date for payment. | |

| Pmnt block/payment method default | ||

| Block Key | Payment Block (Default Value) - Default value for the payment-blocking key. | |

| Payment Method | Payment method - The payment method determines how payments are to be made, e.g. by check, bank transfer or bill of exchange. | |

| Default for Base Line Date | ||

| No default | Indicator: No default for the base date - Indicator that no default value is required for the baseline date for payment. You then have to enter the base date manually during document entry. | |

| Posting Date | Indicator: Propose posting date - Indicator that the posting date is to be proposed in the base date field during document entry. | |

| Document Date | Indicator: Propose document date - Indicator that the document date is to be proposed in the base date field during document entry. | |

| Entry Date | Indicator: Propose entry date - Indicator that the entry date is to be proposed in the field "Base date” during document entry. | |

| Payment Terms | ||

| Installment Payment | Indicator: Term for installment payment - Indicator that the invoiced amount is to be broken down into partial amounts with different due dates. Terms for installment payment are used as an entry tool when entering documents in Financial Accounting. Instead of entering several line items, you only enter the data for one item. The breakdown is carried out by the system automatically by means of the payment terms. |

|

| Percentage | Cash Discount Percentage Rate - Cash discount percentage rate which is granted for payment within the specified period. | |

| No. of Days | Days from Baseline Date for Payment - Number of days following the baseline date for payment after which the payment must be made in order to make use of the corresponding cash discount terms and/or to pay within the due date for net payment period. | |

| Fixed Dates | Due Date for Special Condition - Fixed calendar date as part of the date on which the first or second cash discount period ends and/or the date on which the due date for net payment is reached. | |

| Additional Month | Additional Months for Special Condition (Term 1) Number of months which are to be added to the baseline date for payment in order to determine the end of the first or second cash discount period and/or the date on which the due date for net payment is reached | |

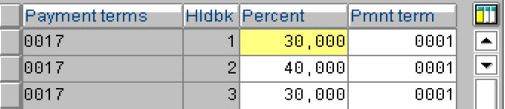

Maintain Terms of Payment – Partial Payment or Installment ( T Code – OBB9)

This configuration is required in case, where invoice are being paid/collected in installment. To give effect to payment in installment we have to configured the payment terms in two steps

Maintain terms of Payment T Code OBB8

Maintain Installment T Code OBB9

In maintain payment terms , we have to maintain two payment terms . 1. for define payment terms as installment 2. what payment terms to be followed for an installment.

In maintain installment steps , we have to define

Installment payment terms

Sequence to be followed for installment

How the amount will be splited in terms of %

What payment terms to be followed for installment