What is Product Price Variance?

The product price variance is a measure of the difference between the actual cost of a product or material and the standard cost. It is calculated by multiplying the difference between the actual price and the standard price by the quantity of the item purchased.

In SAP, PPV information can be accessed through various reports, such as the Material Ledger Price Variance Report or the Cost Analysis Report. This information can be used by purchasing and finance departments to monitor and control purchasing costs, and to make informed decisions about future purchases.

In addition to PPV, the Material Ledger in SAP also provides information on other cost variances, such as quantity variance and activity price variance, which can be used for detailed cost analysis and cost management.

Example

Suppose a company has a standard cost of $10 per unit for a certain product, and they purchase 100 units at an actual price of $9 per unit. The price variance can be calculated as follows:

This indicates that the actual price was $1 below the standard cost, and the company incurred a $100 price variance for the 100 units purchased.

How to calculate product price variance in the context of standard cost?

Before we proceed to calculate product price variance in the context of standard cost, we should know the meaning of standard cost in SAP.

What is Standard Cost?

Standard costs are defined and maintained in the material master record, and they are used in various processes such as production planning, cost accounting, and financial accounting. The system calculates the variances between actual costs and standard costs to provide insights into production efficiency and cost control.

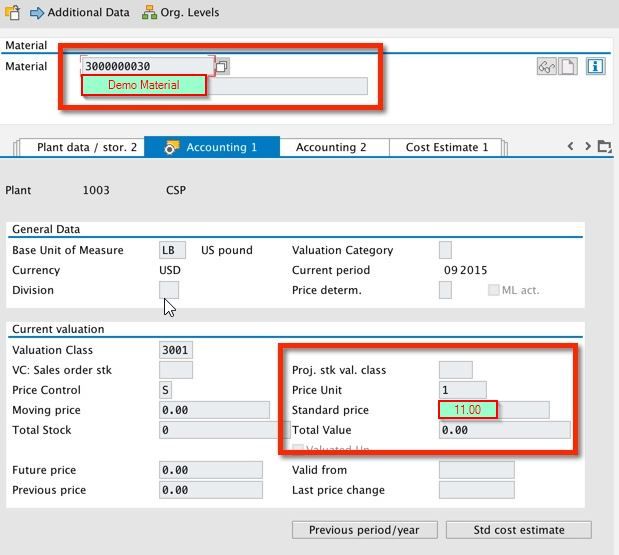

In this tutorial the scenario is defined as buying 1,000 LB of demo material, where:

- The standard cost is 11 USD per LB

- The order cost is 12 USD per LB

- The actual cost is 12 USD per LB

Create Material Master Data

The first step is to create a demo material master data as shown image below:

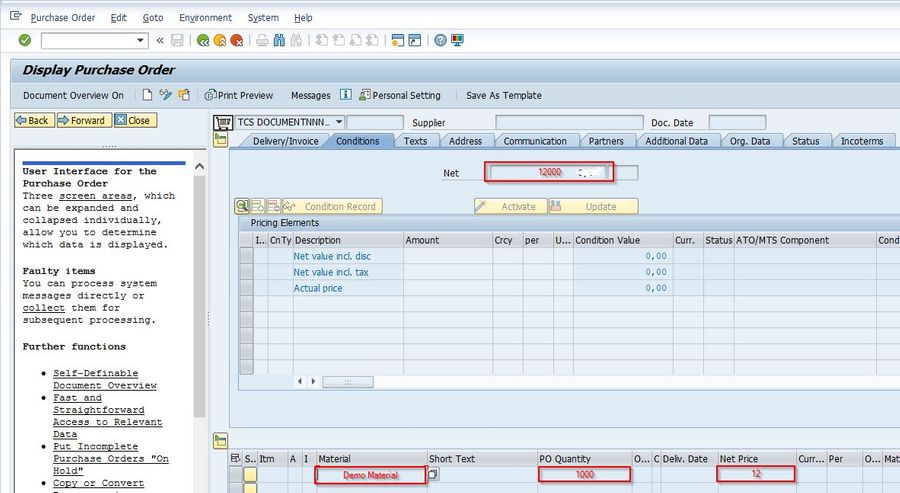

Create Purchase Order

Next, we create a purchase order.

Note: Purchase order cost is more than the estimated standard cost.

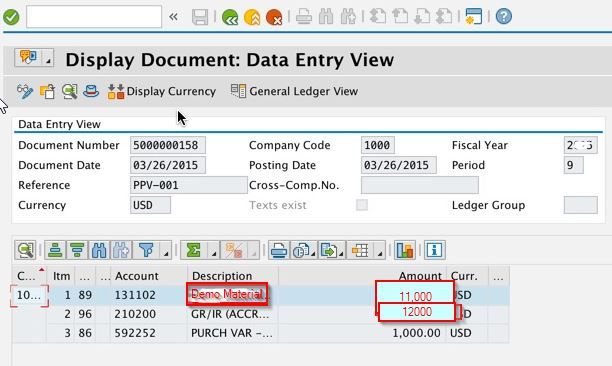

Goods Receipt PPV

Now, we have to assume that we had received the material before the invoice, therefore the difference between the cost will be calculated by:

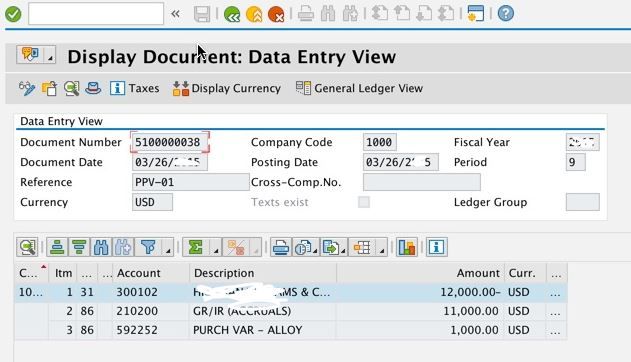

Invoice Receipt PPV

Next, after an invoice is received, we come to know that the market cost has changed and now, the actual price is different than the PO price. Therefore

This implies that Net PPV will be:

This is an unfavorable Purchasing Price Variance.

Note: You can get net PPV with customized reports in the SAP system: