Tax Procedure Configuration for GST

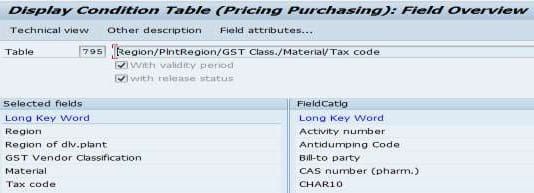

1) Create Condition Table

These condition table combinations are for user reference with the help of these and you create your own condition table as per your business requirement.

Create Condition Table for Material

Transaction code: M/05

Method 1: Dest. Ctry/Region/PlntRegion/GST Class./Tax ind./Ctrl code/Tax code

Method 2: Region/PlntRegion/GST Class./Material/Tax code

Create Condition Table for Services

Transaction code: M/05

Method1: Region/PlntRegion/GST Class./Activity/Tax code

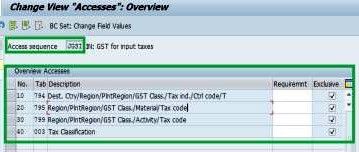

2) Create Access Sequence

Transaction code: OBQ2

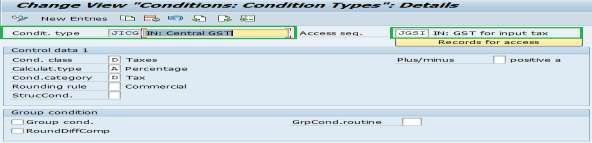

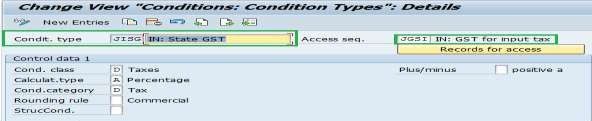

Create Condition Type

Transaction code: OBQ1

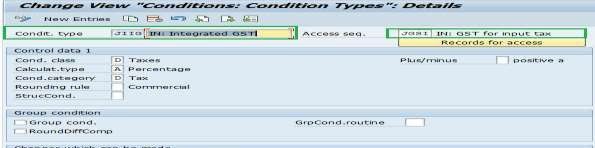

Create Central GST condition type

Create State GST condition type

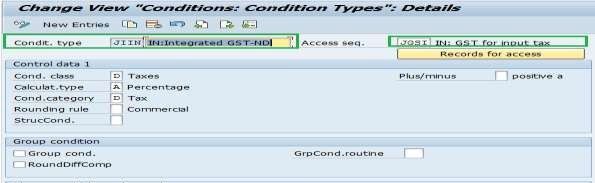

Create Integrated GST condition type

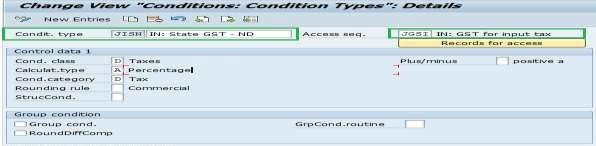

Create State GST Non-deductible condition type

Create Central GST Non-deductible condition type

Create Integrated GST Non-deductible condition type

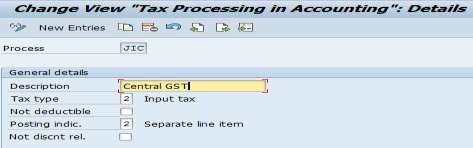

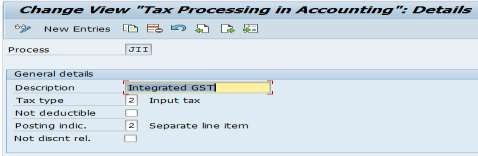

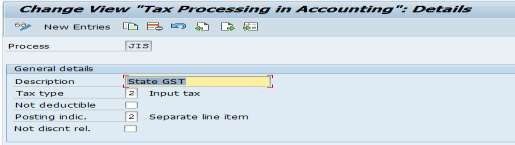

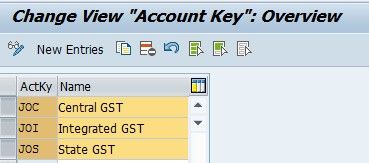

Create Accounting key

Transaction code: OBCN

Central GST

Integrated GST

State GST

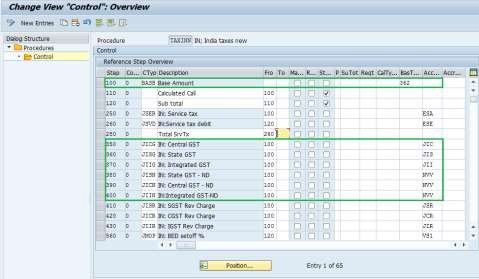

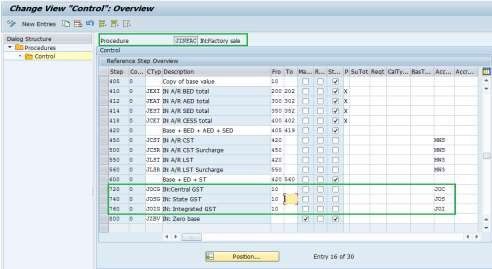

5) Update tax procedure - TAXINN

Transaction code: OBQ3

Note: This is an illustration of GST conditions only, steps may vary from actual,

GST conditions should get calculate on BASE condition, for Non-deductible conditions use standard non-deductible accounting key “ NVV” or your own accounting key

6) Maintain tax percentage rates

You may maintain the tax percentage rates using transaction code FV11, either based on the proposed access sequence or your own access sequence.

Pricing procedure configuration for GST

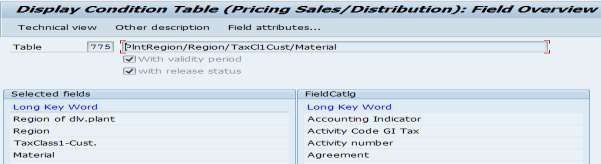

1.Create Condition table

Transaction code: V/05

Create condition table for material

Method1: Country/PlntRegion/TaxCl1Cust/TaxCl.Mat/Region/Ctrl code

Method 2: PlntRegion/Region/TaxCl1Cust/Material

Create condition table for services using transaction code V/05

Method 1: PlntRegion/Region/TaxCl1Cust/Activity

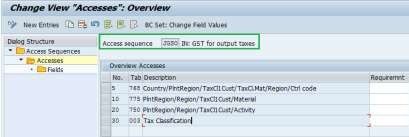

2.Create Access sequence

Transaction code: V/07

3.Create Condition types

Transaction code: V/06

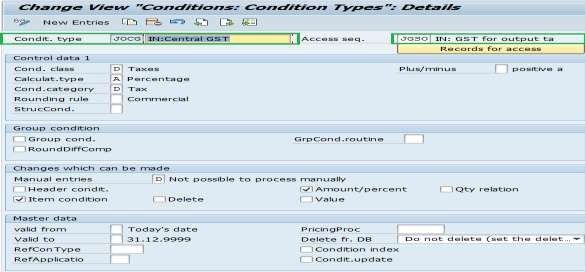

Create output Central GST condition type

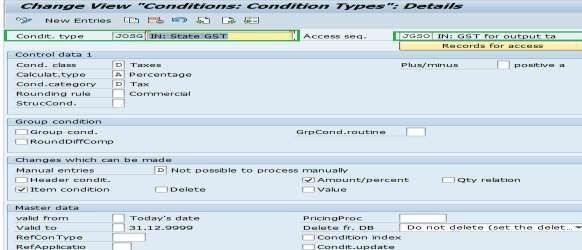

Create output State GST condition type

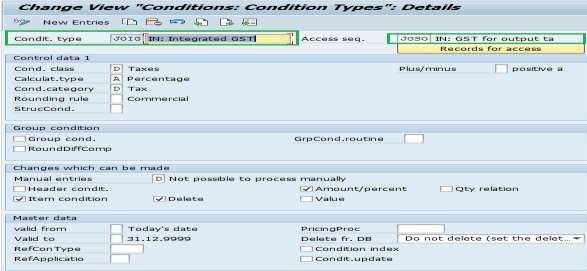

Create output Integrated GST condition type

4.Create Accounting key

Transaction code: OV34

Create sales accounting key for Central GST, Integrated GST and State GST

5.Update Pricing procedure – JINFAC

Transaction code: V/08

Note: This is an illustration of GST conditions only, steps may vary from actual, GST conditions should get calculate on BASE condition

Note: This document is a draft, and provided as a courtesy. This document is not to be considered final, and all information contained herein is subject to change. As such, this document is not to be quoted, cited in any reference, or used by anyone for any purpose other than as a draft document.